The Systemic Risk Council (the Council) observes that a prolonged period of low interest rates, especially in combination with an economic upswing, may entail a risk of systemic financial risks building up. The Council will closely monitor the exposures of financial actors and borrowers against the backdrop of the low interest rates. The Council finds that, at present, no considerable systemic risks have built up in the Danish financial system as a result of the level of interest rates.

Background

The interest rates are historically low and according to market expectations they will remain low in the coming years. The combination of low interest rates and low volatility in the financial markets can induce financial agents and borrowers to underestimate risks and to behave risky. Search for yield can e.g. lead to asset bubbles where prices do not reflect fundamentals. In case of market stress, this can lead to falling asset prices including the risk of self-reinforcing mechanisms via fire sales and lack of liquidity. A prolonged period of low interest rates, especially if it is combined with an upswing in Denmark, can lead to a build-up of systemic risks, e.g. in the interest rate sensitive housing market.

Low international interest rates

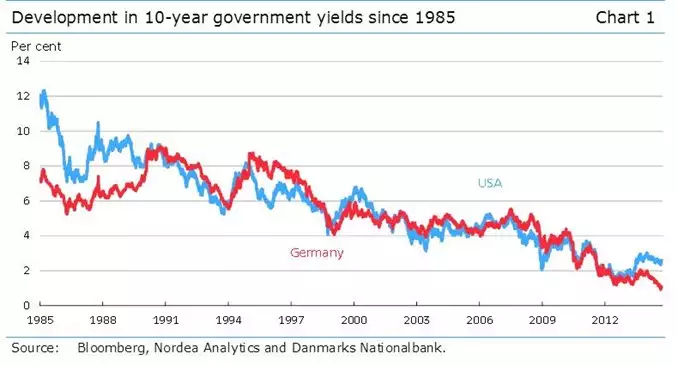

Most countries have experienced falling interest rates for the last three decades, cf. Chart 1. This long-term decline can be attributed to various global factors, such as stronger credibility of monetary policy, a higher propensity to save, accumulation of foreign exchange reserves in the emerging economies and reduced investments in the advanced economies.[1]

The current level of interest rates cannot be regarded without looking at long-term trends, but is also closely associated with the financial crisis. Interest rates in a number of advanced economies have now reached historical lows. Economic growth in the advanced economies is only gradually recovering – a typical pattern after a financial crisis. At the same time, monetary policy has been extraordinarily accommodative in order to buoy the economies.

There are now signs of an upswing in the USA and the UK, while growth in the euro area has been weak. The rate of price increase in the euro area has been below the European Central Bank's, the ECB's, inflation target.

The ECB lowered monetary policy interest rates at the meetings in June and September. Moreover, the ECB announced a number of measures to strengthen monetary policy transmission, including longer-term refinancing operations, LTROs, with a fixed low rate of interest, expiring in 2018. This anchors the market expectation of persistently low interest rates in the euro area in the coming years.

Low interest rates and financial actors' risk assessment

Monetary policy, the financial markets and the real economy are closely interconnected.

If monetary policy is accommodative, economic growth is stimulated as a result of the transmission of lower monetary policy interest rates to the banks' interest rates, mortgage interest rates, financial asset prices and/or credit supply.

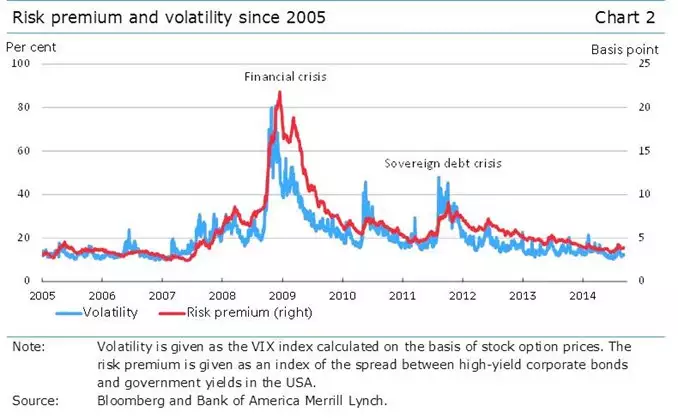

An accommodative monetary policy stance also influences the perception and assessment of risk. This risk channel from interest rates to the economy is particularly relevant in the present economic situation.[2] Low interest rates and modest economic growth currently go hand in hand with financial markets where, in general, uncertainty (volatility) is very low, risk premia are falling, and the prices of most financial assets are rising, cf. Chart 2.

The concept of a risk channel covers a number of mechanisms that may lead to excessive risk-taking, including:

- Low interest rates may, inter alia, lead to a search for yield. This concept generally means a situation where investors seek higher risk in expectation of higher yields.

- An accommodative monetary policy stance may lead investors to expect that central banks will always come to the rescue if developments in the financial markets are contrary to expectations. It may also create expectations of central banks deviating from their inflation targets in prolonged periods.

All in all, a prolonged period of low risk premia, low volatility and rising asset prices may result in inherent expectations of these developments continuing for a long time. This may lead to underestimation of risk – or risk illusion – on the part of both financial institutions and their customers.

The international financial markets and asset bubbles

At present, a number of the mechanisms related to financial actors' pricing and assessment of risk are at play in the international financial markets. There are clear signs of a search for yield. Risk premia are very low, equity prices have risen considerably, and the issuance of more risky assets has generally increased.

Higher asset prices in the financial markets may result in bubbles via self-reinforcing mechanisms. This means that asset prices do not reflect fundamentals such as future earnings, and that financial actors underestimate risks, buying assets in expectation of continued gains.

Experience shows that the existence of asset price bubbles is difficult to ascertain during the build-up phase, and it is also difficult to assess when the rising prices will reverse. This applies in the current situation too. However, a sudden shift in risk assessment can lead to plummeting asset prices, which may be reinforced by sales spirals, where investors could be forced to sell out, entailing sales pressures and further price drops that may spread across assets and amplify due to lack of market liquidity.

Systemic risks can build up if financial institutions – via excessive risk-taking and insufficient risk management – make themselves vulnerable to a reversal of the current financial conditions.

The low interest rate level and the Danish economy

In a small, open economy with a fixed exchange rate policy, like Denmark, the financial conditions are predominantly determined by international factors. Hence, the Danish financial markets are also characterised by modest volatility, rising equity prices and historically low interest rates including monetary policy rates as well as short-term and long-term mortgage rates.

In light of the market expectation that the ECB will not begin to tighten monetary policy until some years into the future, there are now inherent expectations that Danish monetary policy interest rates will remain close to zero in the coming years. The level of interest rates is therefore expected to remain modest for some time to come.[3] This provides an incentive for increased risk-taking, which may cause systemic risks to build up.

Assessment of current systemic risks in Denmark

The Council finds that at present, no systemic risks have built up in the Danish financial system as a result of the level of interest rates.

There is still spare capacity in the Danish economy, and both firms and households have consolidated in recent years.

Lending by banks and mortgage banks has shown only very moderate growth over a number of years. However, there are signs of the banks easing their credit standards. The banks have improved their capital buffers in order to comply with the stricter capital requirements. In addition, the banks' funding deficit in the run-up to the financial crisis has reversed into a funding surplus in relation to households and corporate customers. Consequently, the financial institutions are less vulnerable to a weakening of market access, compared to the period during the financial crisis.

The low level of interest rates has contributed to supporting house price developments. In June, average house prices nationwide were around 25 per cent from the peak in 2007, taking general price developments into account.[4] However, there are substantial regional differences. House prices are rising particularly in the cities, while they have stagnated in other parts of Denmark. Price increases in Copenhagen city are supported by an economic upswing in the city with rising activity, incomes and employment. The population in the Copenhagen and Frederiksberg municipalities has grown by more than 60.000 in total since the beginning of 2009. The supply of homes has lagged behind, resulting in price pressures.

Basis for future build-up of systemic risks in Denmark

Despite the spare capacity in the Danish economy at present, growth may be stronger than projected. If the recovery is stronger in Denmark and occurs earlier than in the euro area, and imported interest rates are low and in sync with the cyclical position of the euro area, it may provide the basis for a build-up of systemic risks in the coming years.

In such a scenario, banks and mortgage banks may take on excessive risk, e.g. by marked easing of credit standards, making themselves more vulnerable to a reversal e.g. in the housing market.

A model simulation of house prices shows that a persistently low level of interest rates in the coming years will entail a marked price reaction compared to a baseline scenario with a gradual increase in interest rates from 2017 onwards.[5] The calculations show that house prices are highly sensitive to interest rates and that low interest rates may provide the basis for stronger developments than projected. This may further support the demand for new lending, which increases the risk of losses in credit institutions in the event of a sudden increase in interest rates, as the number of defaulting loans may rise, while the value of the pledged collateral falls. An economic downturn may thus be accompanied by a substantial fall in consumption as well as a substantial decline in house prices and a credit contraction.

In an international context, Danish households have a very high gross debt. At the same time, variable rate loans account for a far larger share of total lending by mortgage banks compared to ten years ago. A shock to interest rates in the future, when house prices could be markedly higher, may thus have a stronger adverse effect than previously.

Lars Rohde, Chairman of the Systemic Risk Council

[1] See e.g. IMF (2014): "Perspectives on global real interest rates", World Economic Outlook, April.

[2] See e.g. BIS (2014): "84th Annual Report", 1 April 2013 – 31 March 2014, Chapter 2, and Borio and Zhu (2012): "Capital regulation, risk-taking and monetary policy: A missing link in the transmission mechanism?", Journal of Financial Stability, Vol. 8, pp. 236-251.

[3] For example, the yield on 10-year government bonds in Denmark is currently around 1 per cent.

[4] Measured in terms of the private consumption deflator.

[5] Cf. Danmarks Nationalbank, Monetary Review, 3rd quarter 2014 (forthcoming in English).