The low interest rates may lead to rapid build-up of systemic risks

The general level of interest rates has fallen considerably from an already low level since the Council's December meeting. In mid-March, money market interest rates and yields on short-term government and mortgage bonds were negative. The extraordinarily low level of interest rates increases demand for loans from households and firms as well as the credit institutions' incentives to lend on more lenient conditions. The decline in interest rates has come at a time of expansion of the Danish economy that is further supported by inter alia the fall in oil prices in 2014 and a weakening of the effective krone rate.

Conditions underlying the Council's observation from September have intensified. The Council adopted a new observation. The Council observes that the conditions for a rapid build-up of systemic financial risks are in place due to the extraordinarily low interest rates, especially if these are embedded into the expectations of borrowers and credit institutions. The banks and mortgage banks are urged to exercise suitable caution when granting loans on the basis of real property, in particular when granting loans with variable interest rate and deferred amortisation.[1] The observation is enclosed to this press release.

The Council advises the Minister for Business and Growth to maintain the countercyclical capital buffer rate at 0 per cent. The buffer rate is to be set on a quarterly basis. The advice is based on the Council's assessment of main indicators available up until the 3rd or 4th quarter of 2014 and other considerations. The method on which the Council's assessment is based is described in the memo "The countercyclical capital buffer", which can be found on the Council's website.

Follow-up on recommendation on restriction of deferred amortisation on mortgage loans

In the Council's assessment, the Danish Financial Supervisory Authority's indicator for deferred amortisation in the Supervisory Diamond for mortgage banks introduces a restriction on the aggregate volume of deferred amortisation mortgage loans at high loan-to-value, LTV, ratios. As a result, the first part of the Council's recommendation to the government on restriction of deferred amortisation on mortgage lending of 30 September 2014 has been complied with. The indicator will apply from 2020. The government has not, as a supplement to the Supervisory Diamond, introduced legislation to reduce the maximum limit for deferred amortisation loans as a ratio of the property value at the time of granting the mortgage loan. The indicator for deferred amortisation allows a substantial share of borrowers to continue to have deferred amortisation right up to the LTV limit for mortgage loans. The Council finds that systemic risks linked to deferred amortisation are reduced by the Supervisory Diamond but that there are still systemic risks linked to the mortgage banks' opportunities to grant deferred amortisation at high LTV-ratios.[2],[3] The background for the Council's assessment is briefly explained in appendix 1.

With interest rates having fallen even further since the recommendation was issued, the suggestion to reduce the LTV limit for all mortgage loans with deferred amortisation has become even more relevant. Deferred amortisation in combination with the now even lower interest rate level makes it possible to accumulate high debt and still pay very low instalments. This increases the risk of excessive debt accumulation.

Other topics of relevance to the Council

At the meeting, the Council also discussed a range of other topics, among others:

- The Danish Financial Supervisory Authority's survey of new corporate loans. The survey shows signs of a slight easing of credit standards for the corporate sector as a result of increased competition.

- The pros and cons of applying a leverage ratio requirement to credit institutions from a macroprudential perspective. Professor Peter Løchte Jørgensen, chairman of the expert group on a leverage ratio for credit institutions, took part in these discussions.

Enquiries can be directed to mail@risikoraad.dk or Julie Holm Simonsen, press coordinator, on tel. +45 3363 6022.

[1] In Denmark, a mortgage loan typically has a maturity of 30 years. A fixed-rate mortgage loan has a fixed interest rate until maturity. Variable interest rate mortgage loans comprise loans where interest rates are automatically reset typically in intervals of 6 months, 1, 3 or 5 years.

[2] Representatives of the ministries and of the Danish Financial Supervisory Authority have no voting rights in relation to recommendations to the government.

[3] Danish homeowners may take out mortgages for up to 80 per cent of the value of an owner-occupied home. There has been no limit on how much other debt, for instance bank debt, homeowners can raise against the home as collateral. The Danish government has proposed that a 5 per cent down payment requirement be introduced for home-buying households.

Appendix 1: Evaluation of follow-up on recommendation from the Systemic Risk Council

On 30 September 2014 the Council issued a recommendation to impose a restriction on mortgage loans with deferred amortisation. The Council has received the answer from the government (available in Danish only). According to its Rules of Procedure, the Council must assess whether actions or omissions and their underlying rationale, as explained by the recipient, are sufficient. In case a recipient does not comply with a public recommendation, the Council must publish an assessment of the consequences for systemic risk.

In the Council's assessment, the Danish Financial Supervisory Authority's indicator for deferred amortisation in the Supervisory Diamond for mortgage banks introduces a restriction on the extension of deferred amortisation loans at high loan-to-value, LTV, ratios. As a result, the first part of the Council's recommendation to the government has been complied with. The government has not complied with the second part of the recommendation, which was to introduce legislation as a supplement the Supervisory Diamond in order to reduce the maximum limit for deferred amortisation loans as a ratio of the property value at the time of granting the mortgage loan.

The deferred amortisation indicator in the Supervisory Diamond for mortgage banks has been revised since the Council adopted its recommendation. In the government's view, the indicator addresses the current risks in relation to deferred amortisation in a balanced way.

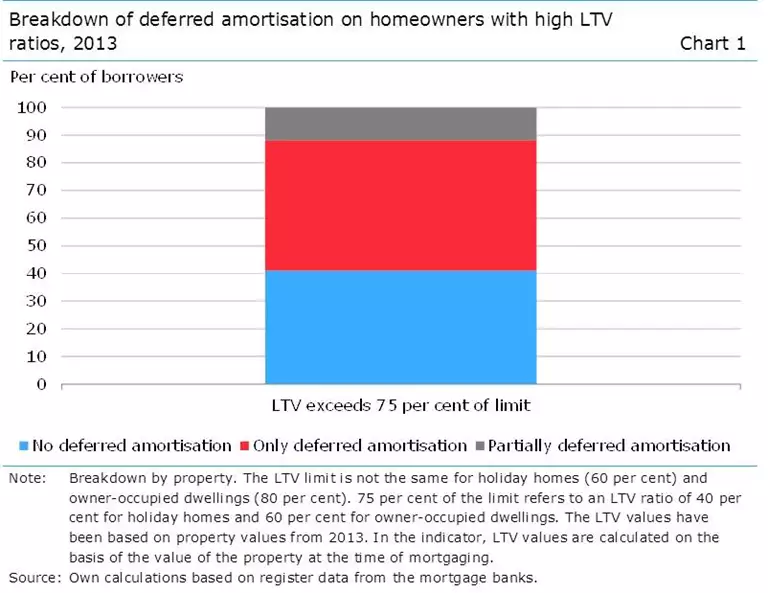

The indicator allows a substantial share of borrowers to continue to have deferred amortisation right up to the LTV limit for mortgage loans. The Council notes that homeowners with high LTV ratios typically opt for either 100 per cent deferred amortisation or no deferred amortisation, cf. Chart 1. The Council expects that this will continue to be the case, as a result of, inter alia, the design of the Supervisory Diamond's indicator.

The Council expects that the Supervisory Diamond will reduce the aggregate volume of mortgage loans with deferred amortisation and induce some borrowers to build up distance to the LTV limit for mortgage loans more rapidly. In the Council's assessment, a substantial share of borrowers will still have deferred amortisation right up to the LTV limit. Overall, the Council finds that systemic risks linked to deferred amortisation are reduced by the Supervisory Diamond but that there are still systemic risks linked to the mortgage banks' opportunities to grant deferred amortisation at high LTV-ratios.