The Council’s recommendation is in response to the uncertainty and challenges associated with the spread of covid-19. It is an extraordinary situation which is associated with considerable uncertainty about the future growth of the global economy as well as the Faroese economy.

Several countries and authorities have reduced capital requirements for banks in order to support lending to businesses and households. The Council can recommend macroprudential measures relating to the banks in the Faroe Islands.[1] Føroya Váðaráð, the Faroese Systemic Risk Council, supports the recommendation. The representatives of the Faroese government,Føroya Landsstýri, on the Faroese Risk Council take note of the recommendation.

The general systemic risk buffer rate has been phased in at 3 per cent from 1 January 2020. The Council recommends that the latest increase from 2 per cent to 3 per cent be temporarily suspended. The Council recommends that the temporary suspension initially runs until the end of 2020. The Council will monitor developments and decide whether to extend this period.

The systemic risk buffer is included in the requirement for the institutions’ Minimum Requirement for Eligible Liabilities, the MREL requirement. The MREL requirement will need to be reduced to reflect the new temporary systemic risk buffer level.

The Minister for Industry, Business and Financial Affairs is responsible for determining the systemic risk buffer rate for the Faroe Islands. The Minister is required, within a period of three months, to either comply with the recommendation or to present a statement explaining why the recommendation has not been complied with.

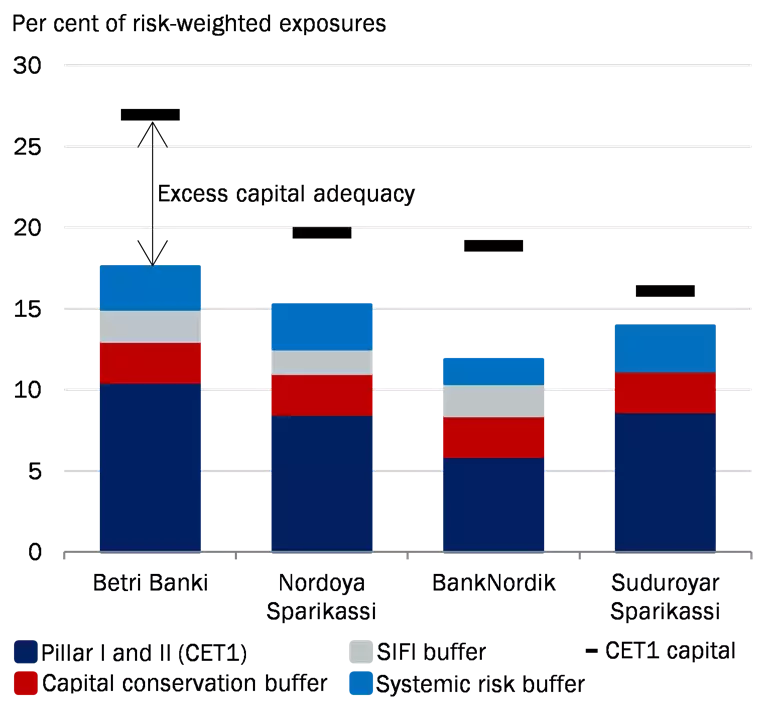

Common equity capital requirement for Faroese banks

The purpose of the general systemic risk buffer is to make the banks more resilient to the structural conditions characterising the Faroese economy, which have historically led to major economic fluctuations.[2]

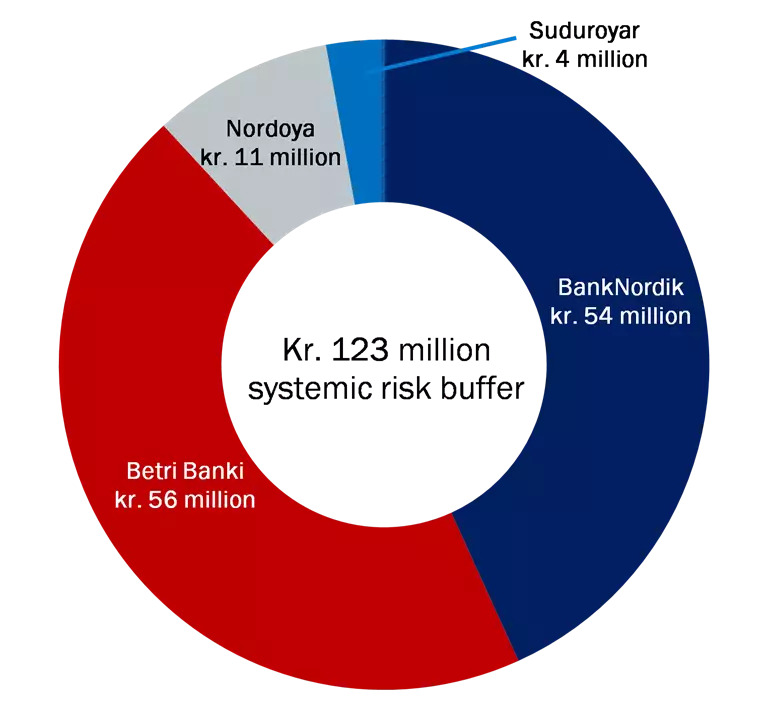

A temporary reduction of the general systemic risk buffer for all four Faroese banks reduces the capital requirements by kr. 123 million, cf. Chart 1 on the right. This enables the banks to absorb losses without having to cut back on their lending.

All capital buffers must be met by common equity capital (CET1). In Chart 1, left, the total CET1 requirement of the four Faroese banks is illustrated together with the banks’ actual CET1. The capital adequacy of all four Faroese banks exceeds the current CET1 requirements.

| Temporary reduction of capital requirements in | the Faroe Islands | Chart 1 |

|---|

Current common equity capital

(CET1) requirements for the Faroese banks |

Distribution of temporary reduction of

general systemic risk buffer to 2 per cent. |

|

|

Note: Left: The Pillar I and II CET1 requirement comprises a general minimum requirement and an institution-specific Pillar II add-on. Up to 44 per cent of the minimum requirement and the Pillar II add-on may be met with types of capital other than CET1, an option which the banks make use of to a varying degree. The SIFI buffer requirement depends on the systemic importance of the banks. The general systemic risk buffer in the Faroe Islands applies only to domestic exposures. The calculation of the excess capital adequacy takes account of the recent release of the countercyclical capital buffer in, for example, Denmark. The release of the countercyclical capital buffer in Denmark has, overall, released capital in the amount of kr. 51 million for the Faroese banks.

Right: Calculated as the product of the change in the general systemic risk buffer rate and the bank’s risk-weighted exposures.

Source: The Danish FSA and own calculations. |

The Council’s recommendation is in compliance with current legislation.

Lars Rohde, Chairman of the Systemic Risk Council

Statements from the representatives of the ministries on the Council

"Legislation regarding the Systemic Risk Council stipulates that recommendations addressed to the government must include a statement from the government representatives on the Council. Neither the government representatives nor the Danish Financial Supervisory Authority have the right to vote on recommendations addressed to the government.

The government shares the Council’s assessment of the current situation and, on this basis, follows the recommendation to suspend the latest increase of the systemic risk buffer in the Faroe Islands from 2 per cent to 3 per cent, which entered into force on 1 January 2020. This will take place with immediate effect."

[1] Føroya Váðaráð, the Faroese Systemic Risk Council, may issue observations, warnings and recommendations relating to Faroese areas of responsibility. As regards the banks, which is a Danish area of responsibility, the Faroese Systemic Risk Council may submit opinions to the Systemic Risk Council in Denmark. According to Faroese law, the opinions cannot be made public.

[2] For a detailed description of the Faroese banking sector and the requirements to be met by the Faroese banks, see the analysis ‘Requirements for Faroese banks’ prepared by the Council in cooperation with Føroya Váðaráð, the Faroese Systemic Risk Council. The analysis was published on 4 March 2020.