Mutual reciprocation of macroprudential measures

Macroprudential measures address risks in the financial system. Such measures are implemented by national authorities in order to prevent risks from becoming so large that they have negative implications for the financial system and the real economy. Macroprudential measures include initiatives such as higher capital requirements and restrictions on credit terms. Since large banks have cross-border activities, a national measure may have cross-border effects. Negative effects may arise e.g. as a result of regulatory arbitrage, whereby banks exploit differences in national regulation and place their activities in the jurisdictions with the lowest requirements. Such negative effects can be mitigated if the relevant authorities in the different countries recognise each other's measures so that the banks are subject to the same requirements. Mutual recognition of macroprudential measures is often referred to as reciprocity.

1. The Systemic Risk Council assesses its own measures

When the Systemic Risk Council makes recommendations on macroprudential measures in Denmark[1], the Council assesses the cross-border effects of the measure in question and considers whether other countries should be asked to reciprocate the measure.[2]

Negative effects can be mitigated by reciprocity

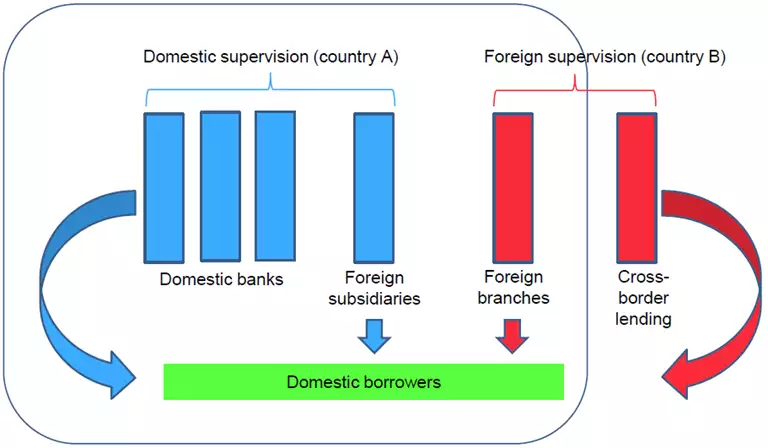

Generally, a macroprudential measure applies only to banks[3] subject to supervision in Denmark. This means that branches of foreign banks and loans directly from banks abroad are not automatically covered by the regulation. So to ensure the effect of the measure in Denmark, it may be important that authorities in other countries reciprocate it. For example, it may be relevant for the Finnish authorities to recognise a Danish measure, as the large Finnish bank Nordea has a branch with a substantial market share in Denmark.[4]

This issue is illustrated in Chart 1. If a measure in country A (Denmark) is not reciprocated by country B (e.g. Sweden), country B's banks may "circumvent" the requirement in country A. Country B's branches in country A will have a competitive edge and may e.g. increase their market shares at the expense of the other banks in country A. This may reduce the intended effect of the measure in country A. So it is in the interests of country A that country B recognises the measure. It may also be in the interests of country B itself to reciprocate the measure in order to protect its own banks against the systemic risks in country A addressed by this measure.

The size of the cross-border effects depends on factors such as the banks' capitalisation, as the impact of a tighter requirement is smaller for a wellcapitalised bank than for a bank bound by the requirement. Furthermore, the banks' business models also play a role in determining how the banks respond to tighter requirements in the host country (country A). For example, a foreign branch (from country B) focusing on corporate lending in country A will not tend to increase its market share if the measure relates to housing loans.

Reciprocation of national measures helps to ensure the effect of the measures and hence financial stability. At the same time, this promotes a level playing field where the same requirements apply to the host country's own banks and to foreign banks with exposures in the host country.

Whether foreign branches and cross-border loans are covered by a macroprudential requirement also depends on the specific measure. Reciprocity may be mandatory, voluntary or not mentioned in the legislation, cf. Appendix 1.

| Chart 1: Illustration of cross-border macroprudential measures |

|

| Source: The ESRB Handbook on Operationalising Macro-prudential Policy in the Banking Sector |

The Council assesses cross-border effects

In its assessment of the need for reciprocation of a macroprudential measure, the Council considers the size of foreign exposures in Denmark. If the volume of foreign exposures is large, recognition by other countries will be important in order to safeguard the effect of the measure. The exposures that are relevant depend on the specific measure, e.g. whether it applies to all credit exposures or to selected exposures such as housing loans. Information about the business models of foreign banks and their strategies for the Danish market is also taken into account where this is possible.

In its assessment of the need for reciprocity, the Council also considers whether the measure in question may have consequences in other countries.[5] The Council's assessment is based on the size of Danish banks' exposures abroad and how Danish banks are expected to respond abroad as a consequence of the Danish measure. In most cases, a measure is expected to have positive effects in other countries. A lower risk that systemic risks will materialise in Denmark also reduces the risk of spill-over effects in other countries that are exposed to developments in Denmark. However, there may also be negative implications. For example, tighter requirements in Denmark may increase Danish banks' risk-taking in other countries if they want a higher risk profile than permitted in Denmark under the new rules. This may contribute to reducing credit standards and lead to the build-up of risks if the other countries are in an expansion phase. Once a year, the Council will assess whether there are any changes in the cross-border effects of measures recommended by the Council.

When authorities in other countries recognise Danish measures, they may exempt banks with very small exposures in Denmark from the requirement.[6] To this end, an institution-specific limit may be set for significant exposures in Denmark. As a main rule, the Council finds that a limit corresponding to 1 per cent of the total exposures that are relevant to the specific measure is appropriate. The limit will be assessed for each individual measure and evaluated when more experience has been gained with macroprudential measures and reciprocity.

2. The Council's approach to other countries' requests for reciprocity

When other countries ask Danish authorities to recognise their macroprudential measures, the view of the Council is that such requests should, as a main rule, be accommodated. That will be the point of departure for the Council's advice to the relevant Danish authority. Banks with negligible exposures to the risk in question may, however, be exempted from requirements resulting from other countries' macroprudential measures.

A foreign authority that requests reciprocation of a macroprudential measure may set an absolute, institution-specific limit relative to total exposures in the country in question. For exposures exceeding this limit, it is important for the host country that other countries reciprocate the measure.

If the foreign authority has not set a limit, the Council finds a relative, institution-specific limit of 1 per cent appropriate. For capital requirements, this means that if a bank's risk-weighted exposures to the risk in question constitute less than 1 per cent of the bank's total risk-weighted exposures, it may be exempted from the requirement. Exposures of that size result in only a very limited additional requirement which does not match the additional administrative costs.[7]

Aiming for a consistent approach to reciprocity

The European Systemic Risk Board, ESRB, recommends a consistent approach to reciprocity within the EU, implying that the relevant authorities generally recognise each other's measures in cases where such recognition is voluntary.[8] As regards the Nordic countries, the supervisory authorities have entered into a Memorandum of Understanding with the aim of ensuring mutual understanding and recognition of supervision and regulation of systemically important foreign branches.

3. Appendix: Overview of reciprocity rules for specific measures

Reciprocity may be mandatory, voluntary or not mentioned in the legislation concerning macroprudential measures. So whether a request must be made to other countries for reciprocation of a macroprudential measure depends on the specific measure, cf. Table 1. The EU's Capital Requirements Directive, CRD IV, has been implemented in Denmark via the Financial Business Act. The EU's Capital Requirements Regulation, CRR, applies directly in all member states.[9]

Mandatory reciprocity applies to the countercyclical capital buffer up to a limit of 2.5 per cent for EU member states.[10] Furthermore, the ESRB recommends that member states generally recognise each other's buffer rates, including buffer rates exceeding 2.5 per cent.[11]

| Table 1: Examples on reciprocity in EU legislation |

| Macroprudential measures |

Legal basis |

Reciprocity |

Countercyclical buffer

Risk wieghts

"Flexibility package"

Systemic risk buffer

Pillar 2 add-ons

Liquidity requirements

O-SII buffer

LTV og L/DTI limits

Loan-to-deposit limits |

Articles 130, 135-140 CRD IV

Articles 124 og 164 CRR

Article 458 CRR

Articles 133-134 CRD IV

Article 103 og 104 CRD IV

Article 105 CRD IV

Article 131 CRD IV

National legislation

National legislation |

Mandatory (up to 2,5 per cent)

Mandatory

Voluntary

Voluntary

Not mentioned

Not mentioned

Not mentioned

Not mentioned

Not mentioned |

Note: LTV: Loan-to-value, LTI: Loan-to-income, DTI: Debt-to-income, O-SII: Other Systemically Important Institutions. Not all instruments in EU legislation have been implemented in all member states. For example, the O-SII buffer does not exist in Danish legislation. Furthermore, loan-to-deposit limits do not exist in Danish legislation.

Source: The ESRB Handbook on Operationalising Macro-prudential Policy in the Banking Sector, CRD IV and CRR. |

[1] And in the Faroe Islands and Greenland.

[2] Recommendations from the Systemic Risk Council are based on the "comply-or-explain" principle. This means that the recommendations must either be implemented or addressees must explain why they are not being implemented. Hence the decision regarding reciprocity is made by the responsible authorities to which the recommendations are made, e.g. the government or the Danish Financial Supervisory Authority.

[3] The term banks is used to refer to financial institutions in general, including mortgage banks.

[4] At present, Nordea's branch is the second largest bank in Denmark, measured by lending volume.

[5] The ESRB recommends that relevant authorities assess whether the macroprudential measure in question has crossborder effects on other EU member states and the EU's single market, cf. the ESRB's recommendation of 15 December 2015 on cross-border effects and voluntary reciprocity (ESRB/2015/2).

[6] Cf. the "de minimis" principle in the ESRB's recommendation of 15 December 2015 on cross-border effects and voluntary reciprocity (ESRB/2015/2). However, the ESRB does not state a limit for negligible exposures.

[7] An exposure of 1 per cent to the relevant risk corresponds to a bank's total capital requirement rising by 0.01 percentage point if the country in question increases the capital requirement by 1 per cent.

[8] See ESRB's recommendation of 15 December 2015 on cross-border effects and voluntary reciprocity (ESRB/2015/2). Like recommendations from the Systemic Risk Council, the ESRB's recommendations are based on the "comply-orexplain" principle.

[9] The Faroe Islands and Greenland are not members of the EU, but both have implemented legislation equivalent to CRD IV and CRR.

[10] The same applies to countries with which the EU has concluded agreements in the financial area

[11] Recommendation of 18 June 2014 on guidance for setting countercyclical buffer rates (ESRB/2014/1).