The government is required, within a period of three months, to present a statement addressing the warning, including whether the warning has induced the recipient to make additional assessments, implement initiatives or the like.

Explanatory statement

It is the task of the Systemic Risk Council to identify and monitor systemic financial risks in the Faroe Islands. The Council can comment on financial matters, including by warning about the development of systemic financial risks. There are clear indications that systemic financial risks are building up in the Faroe Islands.

Historically, the Faroese economy, which is heavily dependent on fisheries, has fluctuated strongly. Currently the economy is in a strong upswing. If the economy is driven by temporary factors, this – combined with high and rising house prices in Tórshavn – could entail a risk that a marked economic reversal will affect the housing market and other sectors. This could lead to large losses for the Faroese banks. Lending to Faroese households and firms is at a relatively high level, although it is lower than the very high level seen in the period 2008-10.

If this development continues, and further systemic financial risks build up, it may be relevant for the Council e.g. to recommend that the Minister for Business and Growth activate the countercyclical capital buffer for the Faroe Islands. Activation of the countercyclical capital buffer should help to prevent a potential economic downturn from developing into a systemic crisis. This is done by increasing the credit institutions' capitalisation, thereby improving the scope for the institutions to maintain a suitable level of lending in periods of stress in the financial system. In such a situation, the buffer may be released and the institutions can use the capital to absorb losses etc. Release of the buffer should prevent the institutions from tightening credit conditions and reducing the supply of credit so much that a credit crunch occurs.

Background

When the economy is growing, the future is often viewed with increased optimism. In recent years, the Faroese economy has continued the strong upswing that began in 2013.¹ In March 2016, the Faroese government assessed that output exceeds the capacity of the economy. The output gap is expected to be 4.3 per cent of GDP in 2016. In its most recent projection, from September, the Economic Council for the Faroe Islands has adjusted nominal GDP growth for 2016 upwards from 5.3 per cent to 8.5 per cent.

If the upswing contributes to overoptimism, this could become a systemic problem. The result could be collective underassessment of risk because people have short memories and the intervals between financial crises are long. When many people change their behaviour at the same time, this could have self-reinforcing effects on the financial system and the real economy. This applies in good times, when optimism turns into overoptimism, but also when the tide turns and everyone becomes more cautious.

Large fluctuations in the Faroese economy

The Faroese economy is heavily dependent on aquaculture and fisheries, and in these sectors activity varies with the size of the stocks. This implies strong economic fluctuations. However, the increasing diversification of earnings across different branches of fisheries helps to reduce the vulnerability of the economy somewhat. At present, demand for fish caught or farmed in the Faroe Islands is high, partly as a result of the Russian boycott of goods from the EU. It is uncertain how long this will continue. An international economic slowdown and discontinuation of the EU boycott could put the Faroese economy into reverse.

Signs of build-up of systemic financial risks

There are signs that the banks have eased their credit standards. In a growing economy, there is often a tendency for optimism to increase. If such optimism leads to risk illusion or excessive risk appetite, it may become a systemic problem. Banks' excessive risk appetite may be reflected in the banks generally easing their credit standards more than warranted by the underlying economic development. As a result, the banks may become vulnerable overall, even though excessive increases in aggregate lending are not observed.

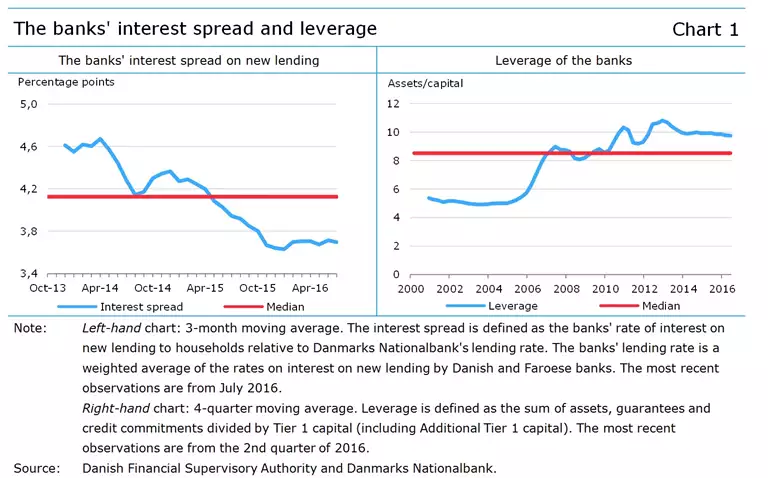

One indicator of credit standards is the banks' rate of interest on new lending to Faroese households relative to Danmarks Nationalbank's lending rate. This interest spread has been declining sharply in recent years, cf. Chart 1 (left).

Furthermore, the banks' leverage is high, cf. Chart 1 (right). High leverage means that the banks are more vulnerable as they have less capital relative to total assets. Hence, large losses in connection with a potential downturn could reduce the capital base considerably. In that situation, the banks may find it difficult to maintain their lending to households and firms, with potentially negative implications for the real economy.

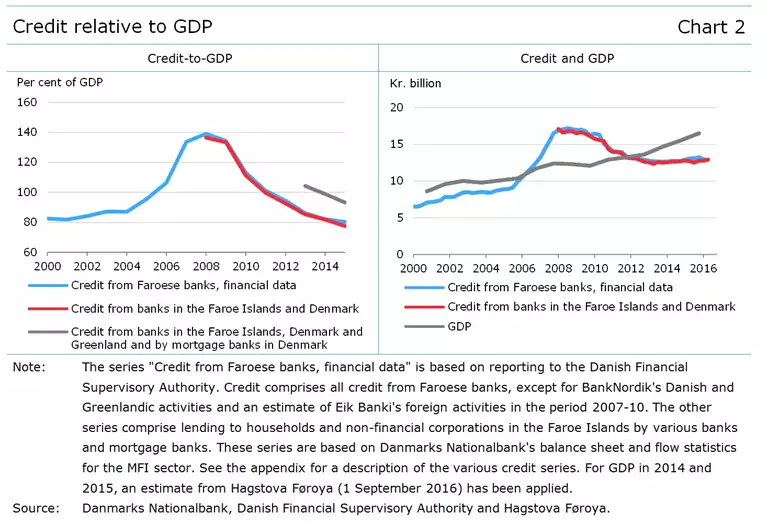

In periods of overoptimism, lending may grow at too fast a pace relative to economic activity in general. Measured relative to GDP, the banks' lending to households and firms in the Faroe Islands has decreased in recent years, cf. Chart 2 (left). So this indicator does not, as such, point to excessive lending. However, this development should be seen in the light of a significant increase in GDP, cf. Chart 2 (right).²

Lending to Faroese households and firms by Faroese and Danish banks is at a relatively high level. Since 2013, lending has been more or less constant, albeit with a slight upward trend over the period. All the same, the level is somewhat below the very high level seen in the years 2008-10. But Faroese firms also raise loans in other countries. Consequently, some credit growth may not be captured in the lending activities of Faroese and Danish banks.

Loans from other countries can be relevant to include in the credit measure, as a period of higher-than-normal credit extension may have a subsequent impact on the Faroese economy and the Faroese banks, even though the latter have not directly been drivers of this development. However, it has not been possible to construct a comprehensive credit measure for the Faroe Islands, cf. the appendix. The Council is working on a more adequate credit measure for the Faroe Islands.

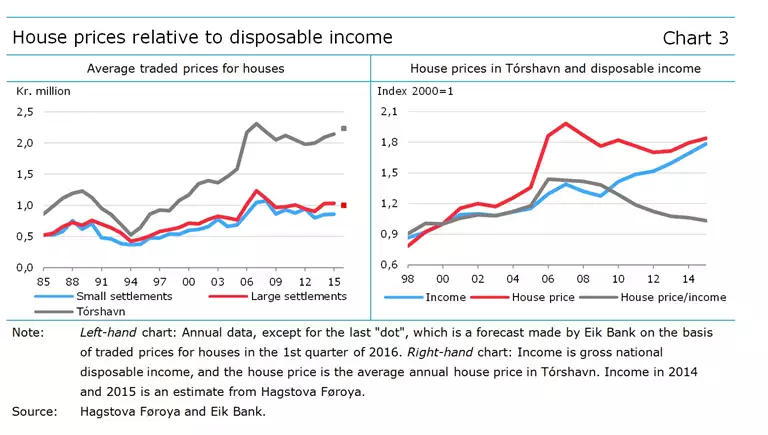

Nominal house prices in Tórshavn have displayed an upward trend since 2012 and are relatively high compared with the peak in 2007, cf. Chart 3 (left). Disposable income has risen more strongly than house prices, so the house price/income key indicator has fallen, cf. Chart 3 (right). This development does not at first glance indicate that systemic risks are building up. But the strong rise in disposable income may be supported by temporary factors so that there is a risk of a downturn. Combined with high and rising house prices in Tórshavn, this could entail a risk that an abrupt reversal of the economy will lead to considerable losses for the Faroese banks.

Lars Rohde, Chairman of the Systemic Risk Council

Statement from the representatives of the ministries on the Council

It is a legislative requirement that warnings issued by the Systemic Risk Council and addressed to the government must include a statement from the representatives of the ministries on the Council. Neither the representatives of the ministries nor the Danish Financial Supervisory Authority can vote on warnings addressed to the government.

The representatives of the ministries take note of the warning issued by the members of the Council about financial risks building up in the Faroe Islands. The representatives of the ministries agree that economic growth is high in the Faroe Islands and that there is a need for vigilance in relation to e.g. developments in house prices. However, the indicators used do not at present point to clear signs of a build-up of financial risks, which typically increase in periods of very high credit growth, when total lending is growing at a faster pace than the economy in general and the underlying structural conditions.

The Danish government will monitor the economic situation in the Faroe Islands.

[1] See the article Current Trends in the Faroese Economy, Danmarks Nationalbank, Monetary Review, 3rd Quarter 2016.

[2] Data for GDP is only available on an annual basis until 2013. For 2014 and 2015, an estimate from Hagstova Føroya has been applied.