The implementation of the Capital Requirements Directive, CRD V, in Denmark, has led to a number of changes to the capital buffer framework, including the systemic risk buffer and the buffer for other systemically important institutions, O-SII buffer, https://www.retsinformation.dk/eli/lta/2020/2110.

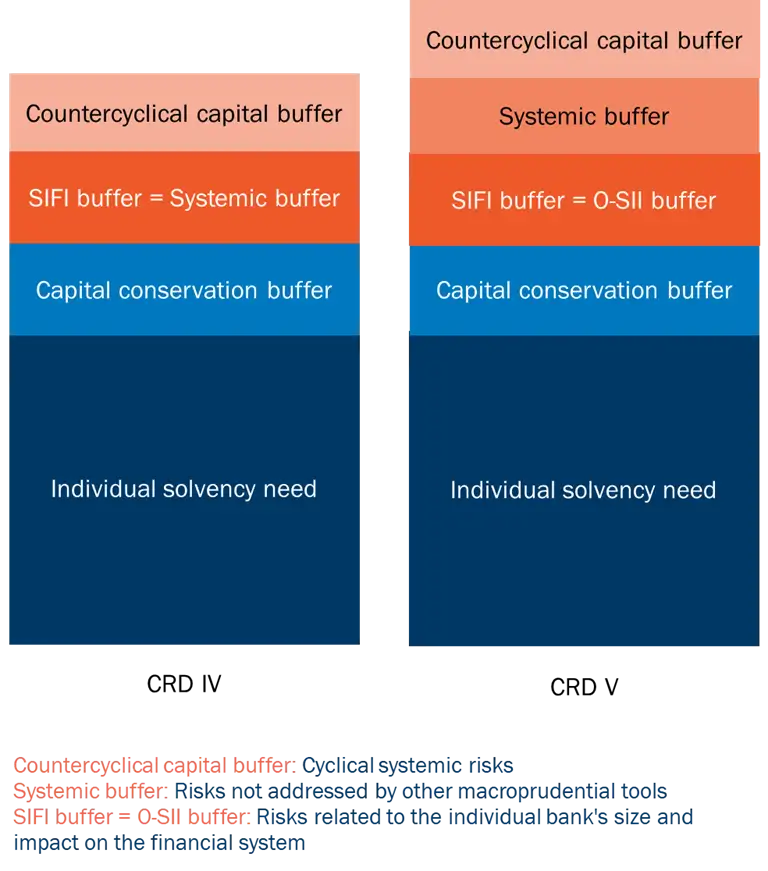

Earlier, the systemic risk buffer was used to set the individual SIFI-buffer requirements in Denmark. With the implementation of the CRDV, the O-SII buffer will be used to set the individual SIFI-buffer requirements. It will thus become possible to set a separate systemic risk buffer, see chart below.

Activating a general or sector-specific systemic risk buffer will as a starting point only apply to banks under Danish supervision. That means that foreign branches and lending directly from banks outside Denmark would not be affected by activating a systemic risk buffer in Denmark. The Danish authorities will have to seek reciprocity with foreign authorities, see also Reciprocation of macroprudential measures.