The Systemic Risk Council, the Council, recommends that the government ensure limitation of housing loans at variable rate and/or with deferred amortisation if the borrower's total debt exceeds 400 per cent of income before tax. The Council recommends that

- the share of such loans be limited to a maximum of 15 per cent of credit institutions' new residential mortgage lending in Copenhagen City and environs and Aarhus,

or that the government implements a similar initiative with equivalent effects on the housing market and lending.

Relative to the existing rules, this initiative will imply a tightening of credit standards for some households in Copenhagen City and environs and Aarhus. Currently, credit institutions can grant such loans to households which meet a wealth requirement.

These households should to a larger extent opt for fixed rate loans with amortisation and/or adjust the size of their mortgages. This will reduce the exposure to a fall in house prices, rising interest rates and negative economic shocks for borrowers in and around the cities, and it may dampen credit-financed house price increases in these areas.

The government is required, within a period of three months, to either comply with the recommendation or to present a statement explaining why the recommendation has not been complied with.

Explanatory statement

The Council's primary concerns are:

- continued high increases in house prices in the large cities,

and as a consequence

- lending growth in the large cities to households with high debt levels and high interest rate sensitivity.

Continued house price increases might lead to overoptimistic expectations about future price developments and induce increased risk taking. The aim of intervening now is to limit the number of highly indebted borrowers, who are particularly vulnerable to a fall in house prices that may coincide with a substantial increase in interest rates. At the same time, this can also contribute to preventing a loosening of credit standards which might push up house prices in and around the largest cities.

There are signs of risk build-up in the areas where house prices have increased the most. More households have opted for high debt-to-income, DTI, ratios – often combined with deferred amortisation and/or variable rate loans – and mortgage lending has grown faster than incomes. If this development continues, there is a risk that a significant increase in interest rates and a sharp fall in house prices will leave many borrowers with high debt, a low disposable income and technical insolvency.

Rising house prices and a higher number of highly indebted households may entail systemic risks

Credit standards slipped markedly in just a few years prior to the financial crisis. An increasing share of residential mortgage lending was granted to households with high DTI ratios, and deferred amortisation loans and variable rate loans quickly became widespread. The proposed initiative is intended to prevent a repetition of this scenario. When the housing market reversed, Danish households – and hence credit institutions' balance sheets – were vulnerable to negative economic shocks. However, falling interest rates contributed to buoying up household finances when house prices reversed and the financial crisis struck.

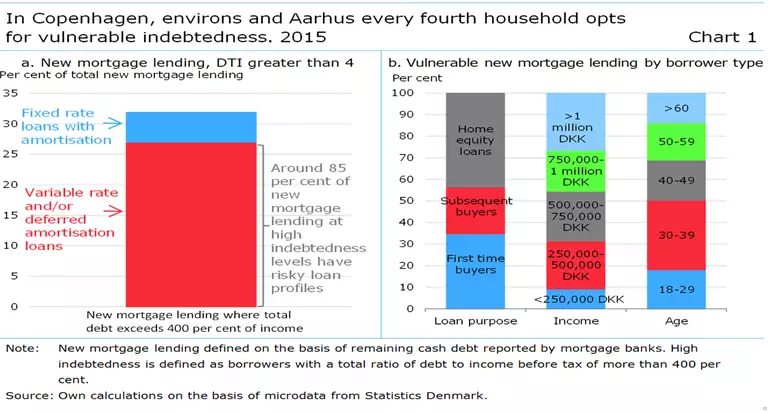

Mortgage lending is still increasing in the large cities, where house prices have increased the most, see Chart 2, Appendix A. The very low interest rates enable households to take on a high level of debt. That might contribute to an increase in households' vulnerability and may push up house prices. A rising share of new residential mortgage loans is granted to households with high DTI ratios (exceeding 400 per cent), see Chart 3 in Appendix A. In 2015, around 85 per cent of new borrowers with high DTI ratios opted for deferred amortisation and/or variable rate loans, see Chart 1a.

Since the financial crisis, interest rates have shown an almost unbroken downward trend. The resilience of the financial system has not been tested in practice in a scenario with rising interest rates combined with falling house prices. The higher the level of indebtedness, the more vulnerable households are to unemployment and interest rate increases, especially if they have variable rate and/or deferred amortisation loans. An unfortunate – but not unlikely – combination of interest rate increases, house price falls and/or higher unemployment could have worse implications for the financial system than those seen during the financial crisis, when interest rates fell. Credit institutions may have to make large, unexpected loan impairment charges due to a higher number of distressed loans. At the same time, the value of the collateral behind residential mortgage lending will be undermined, which will increase the need for capital. Moreover, the economy may slow down, and the impact may be reinforced if more households have high DTI ratios.[1]

Contribution to preventing slipping credit standards

Tighter regulation of loans with a high debt factor will contribute to preventing slipping credit standards in a future scenario, where an increasing share of households would be able to finance high DTI levels by means of variable rate and/or deferred amortisation loans.

High indebtedness can be justifiable in some situations. However, house price increases that exceed income growth for a prolonged period may potentially lead to a strong increase in the share of households taking up high debt relative to their incomes.[2]

Fixed rate loans with amortisation are less risky, despite high DTI ratios. This loan type eliminates the direct exposure to interest rate increases, reduces the LTV ratio over time and offers the possibility of reducing debt service payments at a later stage if the need arises, e.g. due to unemployment.[3]

The proposed initiative builds upon the Danish Financial Supervisory Authority's recent guidelines on prudent credit assessment when granting housing loans in growth areas. The guidelines include wealth requirements for home buyers with high indebtedness relative to income in areas with strong price rises. The preliminary experience with the guidelines and other recent measures is described in Appendix B. The international organisations, the International Monetary Fund, IMF, and the European Systemic Risk Board, ESRB, have welcomed the new measures and pointed out the need for further measures.[4]

Comparable countries that have introduced a limit on high indebtedness relative to income have seen a reduced share of new lending with particularly high loan to income, LTI, ratios. The overall volume of lending is not assessed to have been affected notably. The UK and Ireland have had this type of limit in place since 2014 and 2015, respectively, see Appendix C. In Norway, the authorities have introduced a similar limit effective from the beginning of 2017.

A small share of borrowers with variable rate and/or deferred amortisation loans will have to take up different loans

In 2015, around 25 per cent of new mortgage loans in Copenhagen and environs and Aarhus had variable rate or deferred amortisation while at the same time the DTI ratio was more than 400 per cent. Different loan purposes, age and income groups were represented, see Chart 1b.

With the proposed initiative, around 10 per cent of new residential mortgage lending in Copenhagen and environs and in Aarhus must be granted at a lower level than in 2015 or be fixed rate loans with amortisation. The limit for high indebtedness of 15 per cent of new lending has been set with cautious phasing-in in mind. It may be necessary to tighten the limit further when more recent data becomes available.

Overall, the Council assesses that the proposed initiative ensures a sensible balance between the need to prevent systemic risks from building up and the need for credit assessment flexibility and avoidance of heavy administration burdens on the institutions.[5] It addresses the credit institutions' wish for flexibility in the credit assessment process and transparency in relation to borrowers, which the institutions emphasised in connection with the Council's hearing in the autumn of 2016.[6]

There are no barriers in EU law to introducing a limit on loan size relative to the borrower's income.[7]

Any unintended effects must be monitored

Foreign banks' branches in Denmark should also comply with the initiative. New residential mortgage lending by branches of foreign banks currently accounts for around 6 per cent of total new lending. The supervisory authorities of the Nordic countries have entered into a Memorandum of Understanding with the aim of ensuring mutual understanding and recognition of supervision and regulation of systemically important foreign branches. The Council will monitor any inappropriate circumvention of the initiative via credit providers not covered by the initiative. At the same time, the development in Danish credit institutions' foreign credit activities should be closely monitored through close cooperation between the relevant countries' supervisory authorities. Overall, the Council expects the initiative to have positive effects on other countries, see Appendix D.

Lars Rohde, Chairman of the Systemic Risk Council

Statement from the representatives of the ministries on the Council

The representatives of the ministries agree that housing market developments in and around the large cities, combined with high LTV ratios involving variable rate loans and/or deferred amortisation, call for vigilance. The government will assess the need for further initiatives aimed at the housing market and households with high interest rate sensitivity in the light of, inter alia, amendment of the housing taxation rules.

For appendices, see recommendation as PDF.

[1] Andersen et al. (2016) show that Danish households with strongly increasing debt tend to subsequently reduce their consumer spending more than other households. In other countries, there is a relationship between high indebtedness and subsequent contraction of consumption, see Bank of England (2016).

[2] See Danmarks Nationalbank (2016) and Bank of England (2014).

[3] Equity release loans with a low LTV ratio of e.g. 40 per cent can also be regarded as less risky, although the level of indebtedness relative to income is high.

[4] See IMF (2016) and ESRB (2016).

[5] Exemptions/adjustments for banks with very small loan portfolios would not be contrary to the spirit of the recommendation.

[6] The Council's discussion paper and conference on initiatives in relation to the property market.

[7] According to an EU Directive, it should be possible to introduce such limits in all EU member states, see EU (2014).