The Systemic Risk Council (the Council) recommends to the Government to restrict Danish homeowners' access to interest-only mortgage loans. The measure means that Danish homeowners cannot take out interest-only mortgage loans or mortgage-like bank loans secured upon real property if the loan-to-value ratio of their home exceeds 60 per cent. In 2020, just under half of the mortgage credit institutions' new lending to homeowners with a loan-to-value ratio above 60 per cent was with deferred amortisation. The initiative will entail that, in future, such homeowners would have to amortise on their loans or adjust the desired loan amount. The primary purpose of the initiative is to increase the resilience of homeowners – and the Danish economy – to falling house prices, increasing interest rates and other negative economic shocks that may impact the individual homeowner or Danish economy more generally.

The Government is required, within a period of three months, to either comply with the recommendation or to present a statement explaining why the recommendation has not been complied with.

Why should access to interest-only loans be limited for highly indebted borrowers?

Persistent low nominal interest rates in Denmark and Europe allow Danish homeowners to take on very high levels of debt compared to their income. The continued widespread use of deferred amortisation exacerbates this trend. When both short-term and long-term mortgage interest rates are very low, so is the interest burden for homeowners, see Chart A.1 in Appendix A. In practice, the mortgage debt amortisation therefore determines how high potential home buyers can bid up the price for a home for sale. A requirement that the most highly indebted homeowners repay their debt will increase the overall housing burden for these homeowners, thereby capping their level of indebtedness, and thus also how high they can bid up house prices. The initiative will thus also contribute to reducing the interest rate sensitivity of house prices. However, the primary objective of the initiative is to make homeowners more resilient, thereby also increasing the resilience of banks' and mortgage credit institutions' balance sheets.

Danish homeowners are among the most highly indebted in the world in terms of gross debt relative to disposable income. The high gross debt is matched by significant assets in the form of housing wealth and pension savings, but it makes the Danish economy and the financial system vulnerable to unfavourable housing market developments. The current economic outlook coincides with soaring house prices, record levels of trading activity and a very low housing supply, close to levels in 2006, see Charts A.2 – A.4 in Appendix A. This provides ground for build-up of systemic risks in the form of, for example, loose credit standards, higher lending growth and greater optimism about continued house price increases. This exacerbates the risk that house price increases might be replaced by subsequent falls.

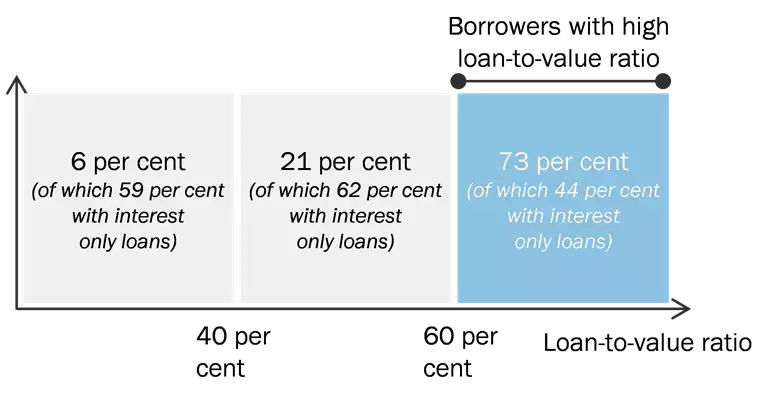

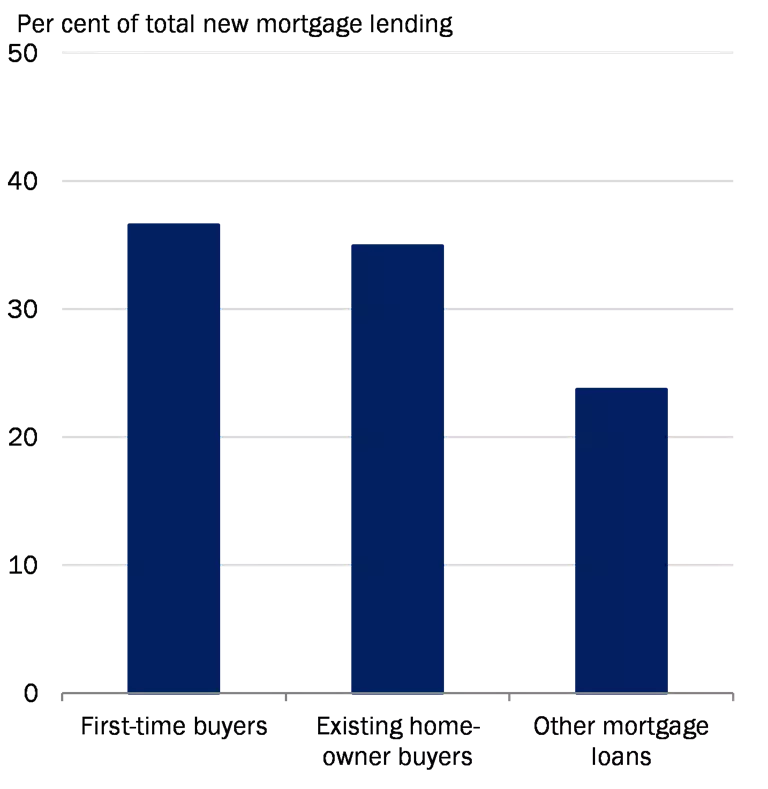

The current lending rules do not adequately address the systemic risks associated with the continued widespread use of deferred amortisation. In 2020, 73 per cent of mortgage credit institutions' net new lending was with a loan-to-value ratio above 60 per cent, see Chart 1. Among the most highly indebted borrowers, with a loan-to-value ratio above 60 per cent, 44 per cent of net new lending was with deferred amortisation. Today, the most highly indebted borrowers are more inclined to choose fixed interest rates rather than variable rates. This should be seen in light of a decrease in long-term interest rates and the Government’s implementation of the Council's recommendation from 2017. It reduces the borrower's interest rate risk and shields the home equity against house price falls resulting from interest rate increases, but it does not address the systemic risks associated with homeowners being able to leverage themselves up to very high levels when both short-term and long-term interest rates are very low.

| Homeowners with high LTV ratios favour interest-only loans |

Chart 1 |

|

Note: The chart is based on a weighted average of the mortgage credit institutions' net new lending for 2020. The loan-to-value ratio and debt-to-income ratio are based on mortgage debt and the latest available gross income data. Net new lending is defined as lending that increases the outstanding bond debt for a borrower between two periods.

Kilde: Own calculations based on register data from Statistics Denmark |

History has shown that great optimism among Danish homeowners and an environment of sharpened competition in the sector can quickly lead to loose credit standards and an increase in the granting of interest-only loans if the regulatory framework does not constitute a sufficient barrier. It only took just under five years from the introduction of interest-only loans in 2003 until they constituted more than half of all Danish mortgage loans, see Chart A.5 of Appendix A. Danmarks Nationalbank (2011) estimates that up to 60 per cent of unsustainable or bubble-like house price increases in the years leading up to the financial crisis could be attributed to the introduction of interest-only loans. Interest-only loans are a relevant and good product for a number of borrowers, but the empirical evidence shows that widespread use may result in negative externalities at macro level and thus systemic risks.

An important lesson from the period leading up to and during the financial crisis is that systemic risks can build up and materialise rapidly, see, for example, the Committee on the Causes of the Financial Crisis (2013). Denmark was struck unnecessarily hard by the financial crisis, one reason being that no action was taken to intervene when the development was at its highest. Instead, changes in housing taxation rules and the introduction of interest-only loans contributed to some inexpedient structures in the housing market that still exist.[1] Due diligence today therefore requires the implementation of initiatives in due time in order to counteract the build-up of systemic risks. Experience from previous crises shows that bad loans are granted in good times. Banks and mortgage credit institutions are currently experiencing few foreclosures and low loan losses. However, this calls for vigilance rather than the opposite. Furthermore, the timing is good for addressing structural issues in relation to the widespread use of interest-only loans among the most highly indebted borrowers, as it is better for both the economy and individual households to build up resilience during an upswing than during a downturn.

Which homeowners will be affected by the tightening of access to interest-only loans?

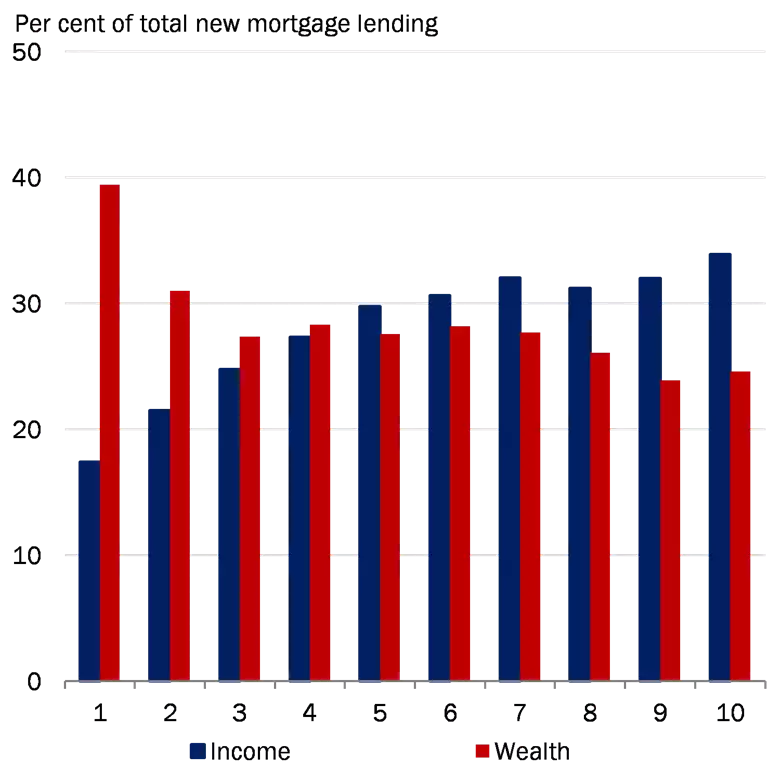

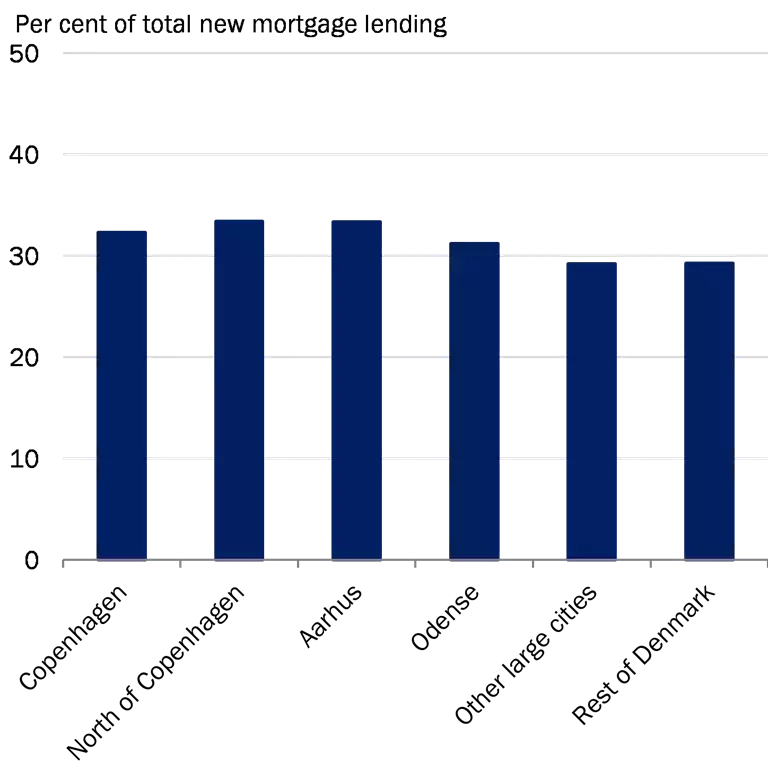

Previous housing market crises have shown that falling house prices have the greatest impact on low-income homeowners in those areas of Denmark where housing market turnover is lowest. Consequently, the geographical areas with the highest house price increases are not necessarily the ones that are subsequently hit the hardest. A general amortization requirement for the most highly indebted homeowners will apply to all homeowners in Denmark, but will have the most limiting effect on homeowners with relatively high incomes and relatively low wealth, see Chart 2 (left). Homeowners with high wealth will be affected to a relatively lesser degree, as they typically have a loan-to-value ratio below 60 per cent. In the municipalities north of Copenhagen as well as in Copenhagen and Aarhus, more homeowners will also have to pay higher instalments than in the rest of Denmark, as the use of interest-only loans is more widespread here, but there is generally geographical equality, see Chart 2 (right) and Chart A.6 in Appendix A

Research shows that the possibility of taking out interest-only loans has not provided easier access to the housing market for low-income groups,[2] as interest-only loans are popular across all groups of borrowers. When many home buyers opt for interest-only loans, they can bid up the prices of houses, leading to general house price increases and pricing out of the market first-time buyers and other low-income buyers. Based on this logic, the initiative will, all things equal, facilitate entry into the housing market for first-time buyers and other groups with relatively low incomes, since limiting access to deferred amortisation will have a greater impact on more affluent groups of homebuyers.

| Share of new mortgage interest-only loans in 2020 with an LTV ratio above 60 per cent by income, wealth and area |

Chart 2 |

| By income and wealth decile |

By area |

|

|

Note: The chart is based on data for the mortgage credit institutions' net new lending for the whole of 2020. Net new lending is defined as lending that increases the outstanding bond debt for a borrower between two periods. The loan-to-value ratio is based on mortgage debt. North of Copenhagen comprises the Municipalities of Gentofte, Hørsholm and Rudersdal. Other large cities include the Municipalities of Aalborg, Esbjerg and Randers. The income deciles have been calculated based on Danish homeowners' gross income in 2019.

Source: Own calculations based on register data from Statistics Denmark. |

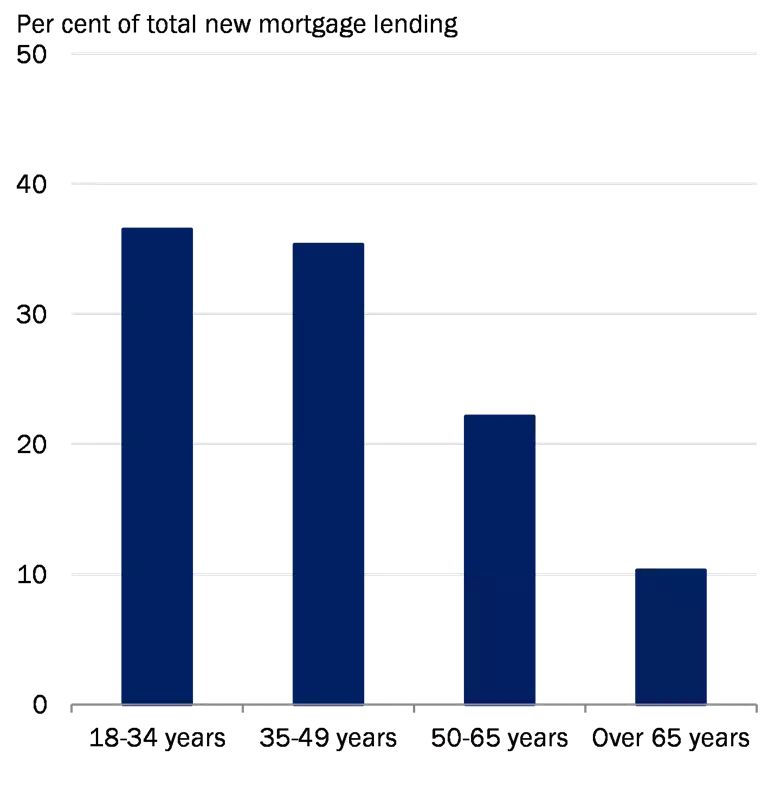

Pensioners will only be affected to a limited extent, as the vast majority of them have a loan-to-value ratio below 60 per cent of the value of their home, see Chart 3 (left). Furthermore, the initiative will have a slightly greater impact on first-time buyers than on existing homeowners, see Chart 3 (right).

| Share of new mortgage interest-only loans in 2020 with an LTV ratio above 60 per cent by age group and home status |

Chart 3 |

| By age group |

By home status |

|

|

Note: The chart is based on data for the mortgage credit institutions' net new lending for the whole of 2020. Net new lending is defined as lending that increases the outstanding bond debt for a borrower between two periods. The loan-to-value ratio is based on mortgage debt. First-time buyers are defined as borrowers who have not previously been registered as having home loans in Statistics Denmark's registers. Other home loans are defined as loans where there has not been a change of address for the household during the same period. These include top-up loans and refinancing.

Source: Own calculations based on register data from Statistics Denmark |

Homeowners with subordinated mortgage loans

The Council discussed whether homeowners with more expensive subordinated loans, such as a bank loan with an LTV from 80 to 95 per cent, can be exempted from the rule and granted interest-only mortgage loans, if the bank loan instalments correspond to the saved instalments on the mortgage loan. It is a sound principle and serves the borrower's interest that the most expensive debt is repaid first. The deferred amortisation period on the mortgage loan can consequently be adjusted to "match" the repayment of the bank debt so that repayment of the mortgage loan commences once the bank debt has been repaid. It can however be argued that amortisation of a large amount of debt, including a bank loan, should be larger than the amortisation of a smaller amount of debt constituting only of a mortgage loan. Furthermore, the practical implementation, enforcement and oversight of compliance with such a model might be challenging.

The effect of the initiative will be monitored by the Council on an ongoing basis

Under the current rules, all homeowners may, in principle, be granted deferred amortisation if they are regarded as being able to service a fixed-rate loan with amortisation.[3] With the current initiative, it will no longer be possible to defer amortisation on mortgage loans if the homeowners' LTV ratio exceeds 60 per cent. This is a change from the current interpretation of the Executive Order on good practice for mortgage lending, see Chart B1 in Appendix B.

It is important that the initiative is implemented so that all providers of mortgage loans and mortgage-like bank loans are treated equally, whether Danish or foreign institutions, and whether banks, mortgage credit institutions or providers of loans secured upon real property from other sectors, for example direct lending from pension funds or the like.

No obstacles in EU law are deemed to prevent the implementation of the initiative. The initiative is not expected to affect credit allocation in other countries.

The Council assesses that the initiative will affect house price increases to a limited extent. The introduction of amortisation requirements in Sweden in 2016 and 2018 indicates that the measures only had a moderate effect on house price developments.

In its ongoing monitoring of the housing market, the Systemic Risk Council will carefully assess whether the initiative has the intended effect. Access to the new Credit Register means that the effect can be measured without long delays.

Statements from the representatives of the ministries on the Council

According to the legal framework for the Systemic Risk Council, recommendations directed towards the government will at their publication include a statement by the representatives from the ministries. The representatives from the ministries and the Danish Financial Supervisory Authority have no voting rights regarding recommendations directed towards the government.

The Government expects, like The Danish Economic Councils, that the large house price increases witnessed over the course of the past year, will eventually subside. The Government notes, that there has been a significant tightening of lending regulation over the past 5-6 years. The government does not plan to initiate new measures targeting the real estate market. The government will carefully monitor residential real estate market developments in the coming months and will use the next three months, in accordance with legislation, to contemplate the Council’s recommendation.

[1] The 2017 housing taxation agreement, which restores the link between property value taxes and house prices, will now not take effect until 2024.

[2] See, for example, Bäckman & Khorunzhina (2020)

[3] In Greater Copenhagen and Aarhus, homeowners must be able to service a loan with an interest rate of 4 per cent, see the Danish Financial Supervisory Authority (2016).