The Systemic Risk Council (the Council) recommends that the Minister for Industry, Business and Financial Affairs reactivate the countercyclical buffer at a rate of 1.0 per cent from 30 September 2022. The buffer was reduced from 1.0 to 0.0 per cent in March 2020 in response to covid-19. The Council finds that it is now time to rebuild the buffer.

Unless there is a significant slowdown in risk build-up, the Council expects to recommend a further increase in the buffer rate to 2.0 per cent by the end of 2021 with effect from the beginning of 2023. Phased buffer increases are in line with the Council's strategy of gradually increasing the buffer rate to a level of 2.5 per cent.

The buffer needs to be built up early so that capital can be released in the event of stress in the financial sector

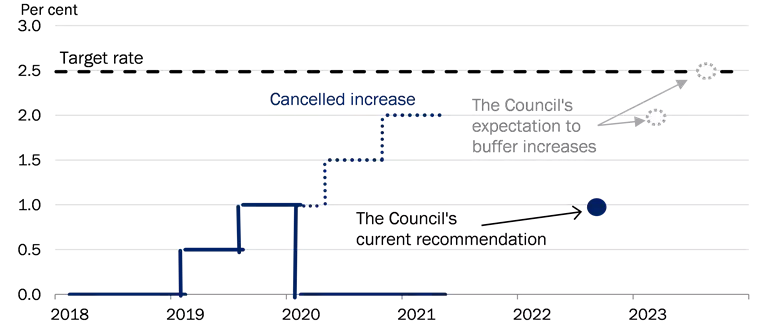

The buffer should be built up before financial imbalances become excessive and the financial sector becomes vulnerable to negative shocks. When the buffer is increased, additional capital will be built up. This capital can be released when a need arises at some point in the future. Therefore, the Council is of the opinion that the buffer rate must be built up to 2.5 per cent quickly and gradually unless there is a significant slow-down in risk build-up in the financial system. With this recommendation, the credit institutions will need to comply with a positive buffer rate from the end of September 2022, see Chart 1.

| The Council wishes to start re-establishing the countercyclical capital buffer |

Chart 1 |

|

Note: The buffer rate shown is the current rate to be complied with by the credit institutions. The point in 2022 shows the earliest time at which the credit institutions will have to comply with a higher buffer rate as set out in the Council's recommendation.

Source: Danmarks Nationalbank. |

If the Council sees signs of a further acceleration in risk build-up, it may be necessary to recommend a quicker increase than the development outlined in Chart 1. Conversely, the Council is also ready to recommend a reduction of the buffer rate, or a cancellation of adopted increases, with immediate effect, if stress occurs in the financial system, and there is a risk of severe tightening of lending to households and companies.

Every quarter, the Council assesses what is a suitable countercyclical capital buffer level. If the Council finds that the rate should be changed, it will publish a recommendation addressed to the Minister for Industry, Business and Financial Affairs. The Minister is required, within a period of three months, to either comply with the recommendation or present a statement explaining why the recommendation has not been complied with.

The Council sets the buffer rate based on an overall assessment of the development in the financial system.[1] In addition to a number of indicators of financial system development, the Council also includes other relevant information, such as other policy measures, as well as current and future requirements to be met by the institutions.

The Council's website contains a number of frequently asked questions and answers with more information on how the countercyclical capital buffer is set in Denmark.[2]

Risk build-up in the financial system

The Council finds that risks are currently being built up in the financial system.

Low interest rates and very loose financial conditions, combined with the economic recovery, provide a basis for continued risk build-up. Risk perception is again low and at pre-covid-19 crisis levels. Equity prices and house prices have soared in the past year. Market participants expect interest rates to remain low for a lengthy period.

Although credit growth has been subdued as a consequence of the government relief packages for the corporate sector, it is expected to pick up as the relief packages are phased out. However, lending to households has continued to increase in the past year, and demand for loans has risen in early 2021 in step with increasing housing market activity. Even if credit growth remains moderate, the risks are exacerbated by lending already being at a high level.

As a consequence of the government relief packages, central government debt has risen sharply in both the United States and Europe. This reduces the likelihood of states being able to mitigate the negative effects of a future crisis. The central banks' room for intervention has likewise been restricted following further interest rate cuts and historically large asset purchase programmes. This highlights the importance of the credit institutions being resilient and having the necessary capital to support their lending in a future crisis situation.

The Danish economy is recovering. Although some sectors are still affected by lockdown measures, others are booming. The general level of economic activity is expected to pick up sharply as sectors affected by the lockdown reopen and the population is vaccinated. The Danes' savings have increased, while the covid-19 crisis has limited consumption opportunities. Rising equity and house prices have contributed to increasing wealth. The disbursement of the last weeks of holiday pay in spring provides an additional activity boost in the housing market or in the sectors that are being reopened.

Like the Danish economy, the international economy is recovering in step with the vaccine roll-outs and the easing of lockdown restrictions. The negative economic effects of new lockdowns in 2021 have been less severe than the negative impacts of the lockdowns at the beginning of the pandemic. The recovery is therefore expected to be faster than projected in connection with the introduction of more stringent lockdown measures at the turn of the year. The recovery of the international economy is important for the recovery of a small open economy like the Danish one.

This assessment forms the basis of the Council's recommendation that the Minister for Industry, Business and Financial Affairs increase the countercyclical capital buffer. The IMF concurs with this assessment. The IMF recommends that the countercyclical capital buffer be built up gradually, unless there is a marked slowdown in risk build-up.[3]

The indicators in the Council's information set have been elaborated on in Appendix A. There is no mechanical correlation between the indicators and the buffer rate, given the uncertainty of measuring the development in systemic risks, including that historical indicators are not necessarily adequate markers of the future development. The Council's buffer rate assessment is therefore based on an overall assessment of the indicators in a more long-term perspective as well as other relevant information, such as interaction with other requirements.

The institutions have the capital required to meet an increase in the countercyclical capital buffer requirement

Virtually all credit institutions will at present be able to meet a requirement for a countercyclical capital buffer rate of 1.0 per cent,[4] including the institutions' capital requirements, MREL requirements and leverage ratio requirements, see the section Other capital requirements. The higher countercyclical capital buffer requirement will enter into force 12 months after the Minister has announced an increase, which means that the requirement will have to be complied with from the second half of 2022 at the earliest. The institutions thus have time to adjust.

A buffer rate increase of 1.0 percentage points raises the total regulatory requirement for Danish institutions' equity by approximately kr. 15 billion. By comparison, the total earnings of the sector were kr. 35.5 billion and kr. 19.6 billion in 2019 and 2020, respectively. The excess capital adequacy was approximately kr. 138 billion at the end of 2020[5].

The requirement that the institutions maintain a countercyclical capital buffer is not a hard requirement. This means that the institutions will not lose their licence to carry on banking business if they fail to meet the requirement. Instead, the institutions will be required to submit a capital conservation plan to the Danish Financial Supervisory Authority, and bonus and dividend payments, etc., may also be restricted if they fail to meet the total capital buffer requirement.[6]

The purpose of the buffer is to increase the institutions' resilience and ensure credit allocation during periods of financial stress

The countercyclical capital buffer is an instrument used to make the institutions more resilient by increasing the requirement for their capitalisation during periods in which risks build up in the financial system. If financial stress occurs with a risk of a severe tightening of credit allocation, the buffer can be reduced with immediate effect, thus releasing capital to the institutions.

To the extent that the institutions do not use the released capital to absorb losses, they may use it for new lending or to secure their excess capital adequacy. This improves the possibility for credit institutions to maintain an adequate level of credit allocation during periods of stress in the financial system. The buffer thus contributes to limiting the negative effects on the real economy.

The Council's strategy is that the buffer should be introduced gradually. This makes it easier for the institutions to adapt to the new, higher capital requirements, for example by retaining earnings. The Council therefore expects that any negative effect on the institutions' credit allocation will be limited.[7]

The buffer is first and foremost an instrument for making the credit institutions more resilient. It cannot be used as an instrument to control financial cycles, neither in an upswing nor in a downturn. The buffer must be released in situations where there is a risk of a severe tightening of credit allocation to households and companies, and therefore not necessarily in connection with a cyclical slowdown.

Other capital requirements

The Council also takes account of other policy measures in its reflections on the countercyclical capital buffer rate. Account is taken of other current capital requirements and eligible liabilities as well as the phasing-in of future requirements for the institutions.

MREL requirement

The MREL requirement is a minimum requirement for the institutions' eligible liabilities (MREL). The MREL requirement has been fully phased in for the systemic institutions except Spar Nord. The MREL requirement will be gradually phased in for Spar Nord and non-systemic institutions towards 2024. The MREL requirement concerns eligible liabilities that can absorb losses and recapitalise an institution in connection with resolution. The MREL requirement differs significantly from the countercyclical capital buffer. The purpose of the MREL requirement is to ensure that the institutions can be restructured or wound up without the use of government funds, and without such resolution having any substantial negative impact on financial stability. This purpose differs from the purpose of the countercyclical capital buffer, which is to make it possible for credit institutions to maintain an adequate level of credit allocation during periods of stress in the financial system. The buffer should preferably have been built up before such a situation occurs. The MREL requirement can be met with several types of capital and debt instruments, whereas the buffer requirements can only be met with Common Equity Tier 1 capital. However, capital used to meet the combined capital buffer requirement, including the countercyclical capital buffer requirement, cannot concurrently be used to meet the MREL requirement.

Overall, the Danish Financial Supervisory Authority assesses that the phasing-in of individual MREL requirements towards 2024 will not have a major impact on the possibility of non-systemic banks to meet a countercyclical capital buffer rate of 1.0 per cent. The Danish Financial Supervisory Authority expects the small banks to, largely, be able to meet the future MREL requirement increases via their existing own funds and through retained earnings. The systemic institutions meet their MREL requirements with their current capital and debt instruments and may, if necessary, increase their excess capital adequacy relative to MREL requirement by issuing MREL instruments or by retaining earnings.

Minimum requirements for eligible liabilities for groups engaged in mortgage lending

From 2022, groups engaged in mortgage lending must meet a new minimum requirement, as eligible liabilities must represent at least 8 per cent of the groups’ liabilities. In practice, this means that if a group's total capital, buffer and MREL requirements (including debt buffer for mortgage lending activities) constitute less than 8 per cent of its total liabilities, the debt buffer for the mortgage lending activities will increase until the total group requirements represent 8 per cent of the group’s liabilities. Some groups engaged in mortgage lending will therefore experience an increase in their MREL requirement. Groups engaged in mortgage lending to a large extent use capital to meet their MREL requirement and debt buffer requirement, but they have ample opportunity to issue additional non-preferred senior debt in their efforts to comply with the MREL requirement.

Leverage ratio

From July 2021, the institutions will also have to meet a minimum leverage ratio requirement. While the buffer is calculated in relation to risk-weighted exposures, the leverage ratio is calculated in relation to non-risk-weighted exposures. For groups with a large share of assets with very low risk weight, such as mortgage loans, the leverage ratio requirement entails a higher capital requirement than the risk-based capital requirement. The leverage ratio requirement and the risk-based capital requirement are two parallel capital requirements that are independent of each other. Therefore, an increase of the countercyclical capital buffer does not affect the leverage ratio requirement.

Output floor

The Basel Committee's so-called output floor is scheduled to be implemented gradually in the EU from 2023 to 2028. According to the Basel Committee, the purpose is to ensure a more uniform calculation of risk-weighted exposures across countries. The output floor requirement limits how low the risk weights can be in the banks' risk assessment of exposures when they use internal models to calculate the capital requirement. For institutions using internal models, this may result in an increase of their risk-weighted exposures and thus also an increase of their risk-based capital requirements. The output floor will be of a permanent nature, whereas the countercyclical capital buffer requirement can be reduced when risks materialise. The output floor must first be adopted by the EU before being introduced for the Danish institutions.

The Council’s recommendation is in compliance with current legislation.

Lars Rohde, Chairman of the Systemic Risk Council

Statements from the representatives of the ministries on the Council

"Legislation regarding the Systemic Risk Council stipulates that recommendations addressed to the government must include a statement from the representatives of the ministries on the Council. Neither the representatives of the ministries nor the Danish Financial Supervisory Authority have the right to vote on recommendations addressed to the government.

The government notes the Council's recommendation to the government to set the rate of the countercyclical capital buffer at 1 per cent with effect from 30 September 2022. The Minister for Industry, Business and Financial Affairs will announce the government's decision on the rate of the countercyclical capital buffer for the 3rd quarter of 2021 as soon as possible."

[1] See the Council's method paper on setting the buffer rate(link)

[2] See ‘Frequently asked questions and answers’(link)

[3] IMF, Staff Concluding Statement of the 2021 Article IV Mission, 11 May 2021.

[4] The institutions must meet the countercyclical capital buffer requirement with Common Equity Tier 1 capital.

[5] This figure covers the excess capital adequacy relative to the institutions' solvency requirements and combined buffer requirements.

[6] In addition to the countercyclical capital buffer, the total capital buffer requirement in Denmark consists of the so-called capital conservation buffer for all institutions and a SIFI buffer for the systemically important institutions, the so-called SIFIs.

[7] Danish experience shows that the increased capital requirements introduced as part of the international regulation after the financial crisis have not resulted in a decline in lending, see Brian Liltoft Andreasen and Pia Mølgaard, Capital requirements for banks – myths and facts, Danmarks Nationalbank Analysis, No. 8, June 2018.