The countercyclical capital buffer was implemented in EU legislation via the Capital Requirements Directive, CRD IV. The Capital Requirements Directive was implemented in Danish law via a revision of the Danish Financial Business Act implemented in March 2014. In Denmark, the Minister for Business and Growth is the designated authority for the countercyclical buffer, i.e. the Minister decides whether the buffer is to be activated and sets the buffer rate on credit exposures in Denmark.

Purpose

In order to strengthen the credit institutions' resilience, the countercyclical capital buffer may be implemented during periods of increasing systemic risk. These are typically periods of very high credit growth. The purpose of the buffer is to facilitate the scope for the credit institutions to maintain suitable credit extension in periods of stress in the financial system. Ideally, the buffer should be built up before the tide turns to ensure that the institutions are more resilient when the financial system is exposed to stress. In that situation, the buffer can be released, and the institutions may use the capital to e.g. absorb losses. Releasing the buffer should discourage the institutions from tightening their credit standards and reducing the credit supply to such an extent as to cause a credit crunch.

The countercyclical capital buffer is an addition to the structural minimum requirement. The structural minimum requirement applies in both good times and bad and aims to ensure that the institutions are basically sufficiently well-capitalised. In addition to this, the countercyclical capital buffer will be built up and released in step with the development in systemic risks that vary over time. The buffer should contribute to ensuring that the institutions are resilient when systemic risks materialise. Hence, the countercyclical capital buffer aims to supplement the structural minimum requirement.

In addition to the primary purpose of strengthening the institutions' resilience, a possible side benefit is that the actual build-up of the countercyclical capital buffer in good times may dampen credit growth, thereby reducing the build-up of systemic risks. It is difficult to quantify the effect on credit growth in the build-up phase, but the effect should not be overestimated in periods of great optimism and high credit growth where it will be relatively easier for the institutions to increase their capital. The buffer is first and foremost an instrument to increase the resilience of credit institutions. The buffer should not be regarded as an instrument to influence cyclical fluctuations.

1. Setting the buffer rate

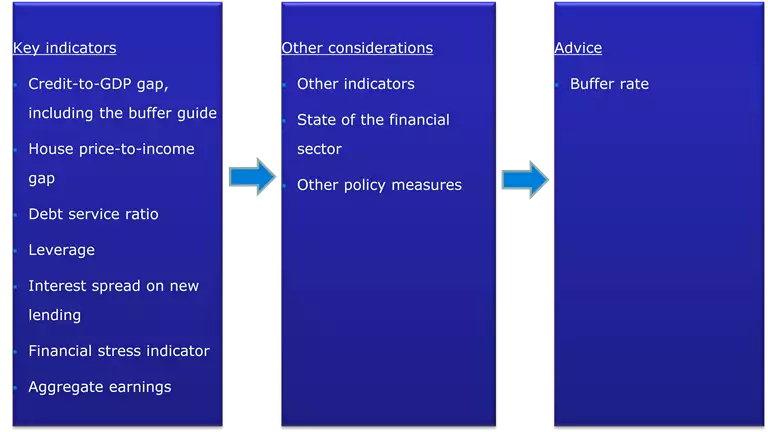

In its assessment of the countercyclical buffer rate, the Council will use a decision model comprising three steps, cf. Chart 1. Overall, the three steps should be used to enable the Council to advise on a final buffer rate. For step 1, the Council has identified seven key indicators that provide information in various ways on the build-up, reduction and materialisation of systemic risks. No indicators are perfect, however. Accordingly, the key indicators are supplemented by other quantitative and qualitative information in step 2. Developments in other indicators and information about the state of the financial sector are used to provide an overview of the overall risk outlook. Furthermore, other policy measures are also taken into account when setting the buffer rate. These may include other measures that are better suited to addressing the risks identified. Further measures may also be planned that it may be relevant to take into account. In step 3, the Council determines the level of the buffer rate based on an overall assessment of steps 1 and 2. The following sections describe the content of the three steps in more detail.

| Illustration of decision model |

Chart 1 |

|

1.1 Key indicators of activation

The Council has selected five key indicators to capture situations of vulnerabilities building up in the financial system, which may cause the buffer to be activated. The key indicators were selected mainly so as to make sense based on the economic arguments described for each indicator below. The indicators were also assessed based on their historical performance in relation to financial crises in both Denmark and abroad. The historical evaluation should, however, be viewed in light of the limited number of crises during the periods for which data are available.[1] Moreover, developments in the indicators were affected by policy measures during the period under review. In Denmark, these include measures to limit consumption, i.e. the October 1986 economic package (the "Potato Cure") and the fiscal-policy tightening in 1998 (the "Whitsun Package"). In its forward-looking assessment of the indicators, the Council takes both the level and recent developments into account.

1.1.1 Key indicator 1: Credit-to-GDP gap

Growing optimism is often seen in an economy during boom periods. If such optimism turns into overoptimism (risk illusion), it may lead to excessive risk-taking among credit institutions. This may be reflected, inter alia, in the latter easing their credit terms. During such periods, credit may increase too strongly. The risk of a period of major losses and a sharp contraction of credit increases when credit standards are eased and credit growth is high.

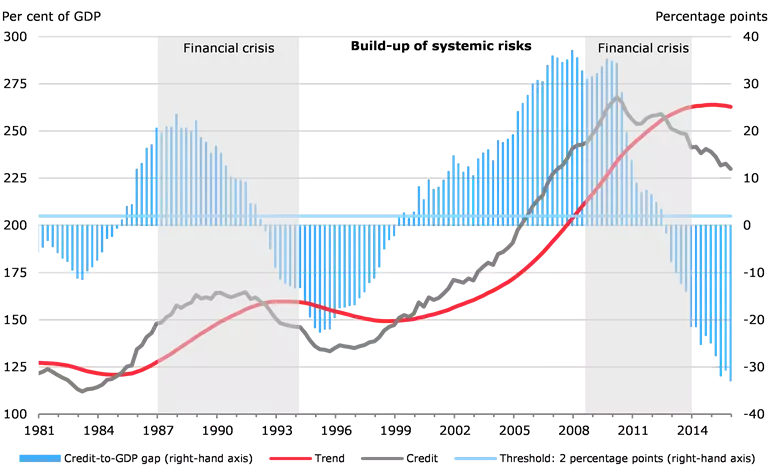

If growth in total lending increases much faster than the general economic growth and underlying structural factors, this is a sign of excessive credit levels.[2] The underlying structural factors cannot be observed directly and develop over time. Technically, the structural level is therefore approximated by a trend.[3] Large positive deviations of the actual credit-to-GDP ratio from its trend, also called the credit-to-GDP gap, may therefore indicate excessive credit growth.

Several international studies suggest that the credit-to-GDP gap is the best single indicator for predicting systemic banking crises across a number of countries.[4] This is the reason why the indicator plays a prominent role in international recommendations on the countercyclical capital buffer, and it is included in the calculation of the buffer guide, cf. Box 1.

The credit-to-GDP gap also indicated the build-up of systemic risks in Denmark prior to the two most recent financial crises in Denmark, cf. Chart 2. But the high level of the credit-to-GDP ratio in Denmark is not reflected in the credit-to-GDP gap, as this is defined as a deviation from its trend. High debt may result in increased financial vulnerability, however.[5] Therefore, the Council will assess how a high starting point may influence the build-up of systemic risks, and whether a stronger response to excessive credit growth is needed when the level of the credit-to-GDP ratio is high. Furthermore, the Council will assess whether there are technical reasons for the development in the credit gap which are attributable to the calculation of the trend. E.g. the trend continues to increase after periods of growth in the credit-to-GDP ratio independent of the structural development, cf. Chart 2 and Appendix A.

| Credit-to-GDP ratio, trend and credit-to-GDP gap |

Chart 2 |

|

Note: The credit-to-GDP gap is defined as deviations of the ratio of credit-to-GDP from its long-term trend. GDP is a 4-quarter sum. See Appendix A for more details about the definition of credit and trend calculation. The series have been adjusted for data breaks back in time. The threshold is in accordance with international recommendations, cf. Box 1.

Source: Abildgren (2007), Abildgren (2010), Statistics Denmark, the MONA data bank, Danmarks Nationalbank and own calculations. |

The credit-to-GDP gap measures one way in which systemic risks of relevance in relation to activating the buffer may be expressed. The vulnerabilities may also be built up in other ways to be captured by the other key indicators. For example, borrower vulnerability to rising interest rates or falling house prices may increase, or the vulnerability of the institutions may increase due to high leverage. Hence, the other key indicators contribute information that is not necessarily captured by the credit-to-GDP gap.

| The buffer guide |

Box 1 |

|

The buffer guide is a mechanical calculation based on the credit-to-GDP gap. It is an internationally consistent starting reference point, cf. ESRB (2014) and BCBS (2010). When the buffer guide is greater than zero, the relevant authorities must consider whether to activate the countercyclical capital buffer. As the buffer guide is based on a single indicator, it cannot stand alone. Therefore, other quantitative and qualitative information must be included in the decision-making basis with a view to setting the final (applicable) buffer rate. The ESRB recommends that the buffer guide should be published together with other relevant indicators and a justification of the final buffer rate.

The buffer guide is calculated using two thresholds: a lower threshold of 2 percentage points and an upper threshold of 10 percentage points. The buffer guide is set at zero when the credit-to-GDP gap is lower than 2 percentage points. When the credit-to-GDP gap exceeds 10 percentage points, the buffer guide is set at 2.5 per cent of the total risk exposure amount. Hence, there is a cap on the buffer guide, although the final rate may be set at a higher value if warranted by the assessment basis. The buffer guide is calculated linearly between the two thresholds.1 The chart shows the correlation between the credit-to-GDP gap and the buffer guide based on the Danish data.

|

| Credit-to-GDP gap and the buffer guide |

|

Note: The credit-to-GDP gap is defined as deviations of the ratio of credit-to-GDP from its long-term trend, cf. Chart 2.

Source: Abildgren (2007), Abildgren (2010), Statistics Denmark, the MONA data bank, Danmarks Nationalbank and own calculations. |

| 1: The specific formula is given by: (2.5 * (credit-to-GDP gap – 2))/8, where 8 is the difference between the upper and lower threshold (10-2). |

1.1.2 Key indicator 2: House price-to-income gap

The value of the collateral that borrowers are able to provide increases during periods of great optimism and rising house prices. As housing is the primary source of collateral for loans, developments in house prices and credit will often be related. When house prices go down, collateral values are reduced, thereby increasing credit institutions' and households' risks. Furthermore, falling house prices may cause households to reduce their consumption. This may have an impact on the real economy and corporate activity, which may in turn lead to a higher risk of losses for the credit institutions. Hence, in a situation of falling house prices, it is expedient for the credit institutions to have excess capital.

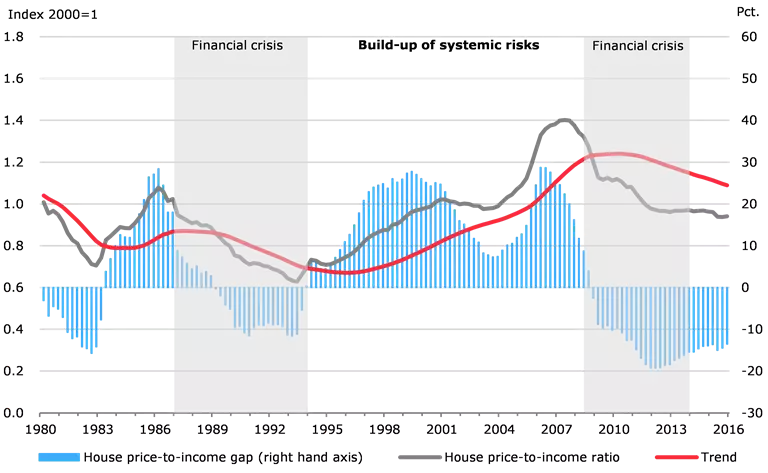

If house prices rise more than incomes, this may indicate an unsustainable increase in house prices. However, the fact that the ratio of house price to income (the house price-to-income ratio) rises over time may be attributable to structural factors. But since it is difficult to determine a sustainable level of the house price-to-income ratio, a simple approach is to consider a trend. Large positive deviations of the house price-to-income ratio from its trend, also called the house price-to-income gap, may indicate that the housing market is overvalued.[6] The house price-to-income gap increased well in advance of the two most recent Danish crises, though it began to decrease before the onset of the crises, cf. Chart 3.[7]

Historically, substantial increases and falls have both occurred earlier (around three years) for the house price-to-income gap than for the credit-to-GDP gap. One exception is the period from 1999 to 2003, during which the house price-to-income gap was reduced, while the credit-to-GDP gap continued to increase.[8] The opposite developments in the credit-to-GDP and house price-to-income gaps emphasise the importance of seeking a better understanding of the background to developments in the key indicators.

| House price-to-income gap |

Chart 3 |

|

|

Note: The house price-to-income gap is defined as deviations of the ratio of house price to income from its long-term trend. The trend is estimated for the period from 1st quarter 1973 to 4th quarter 2015 and calculated in the same way as for the credit-to-GDP gap, cf. Appendix A. The trend is not indexed. The house price is measured by the price of single family houses from Statistics Denmark, and the income as 4-quarter sums of households' disposable income from the MONA data bank of Danmarks Nationalbank. Both series are seasonally adjusted. Disposable income has been adjusted for data breaks back in time and adjusted for the extraordinary tax revenue from the restructuring of capital pensions etc. in 2013-15.

Source: Statistics Denmark, the MONA data bank and own calculations.

|

1.1.3 Key indicator 3: Debt service ratio

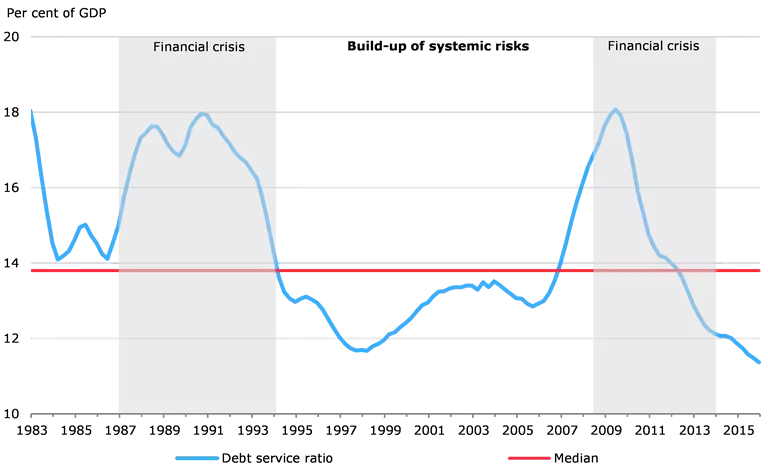

If borrowers spend large parts of their income on debt service, i.e. they have a high debt burden, they are more vulnerable to economic shocks. Economic shocks might include reductions in household income, lower corporate earnings or higher debt service costs. The latter could be attributable to e.g. increases in interest rates. Borrower vulnerability increases the credit institutions' risk of losses.

One indicator of private sector indebtedness is the debt service ratio, which is an expression of borrowers' interest payments and debt repayments relative to total income measured by GDP.[9] The indicator rose prior to the most recent crisis, cf. Chart 4. Data available from the period up to the first crisis indicate that there was also a substantial increase in the debt service ratio immediately prior to the crisis period.

| Debt service ratio |

Chart 4 |

|

|

Note: 4-quarter moving average. The debt service ratio is defined as households' and non-financial corporations' interest payments and debt repayments relative to GDP. Interest payments and debt repayments are estimated in accordance with Drehmann and Juselius (2012) until 2002. From 2003 these are supplemented by actual interest payments and debt repayments for mortgage banks. The series has been adjusted for data breaks back in time.

Source: Abildgren (2010), Statistics Denmark, Danmarks Nationalbank and own calculations.

|

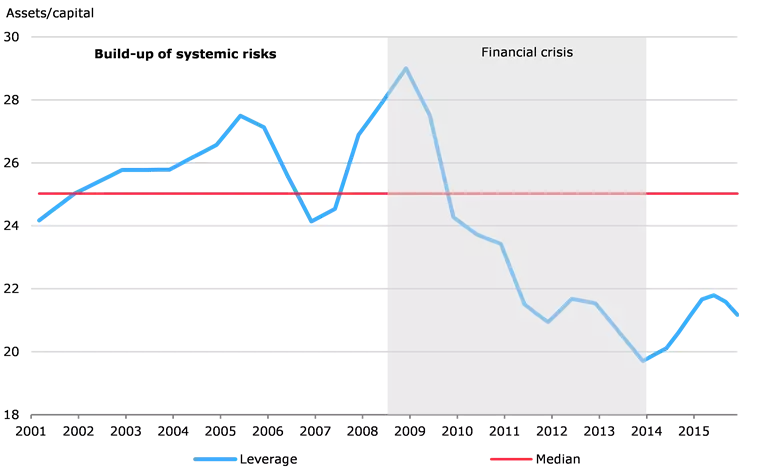

1.1.4 Key indicator 4: Leverage of credit institutions

Increasing leverage means that the banks' debt increases relative to their equity. Leverage may increase as a result of assets rising without a corresponding increase in equity. All else equal, this points to the institutions' resilience being reduced, and hence, the sector becomes more vulnerable. High leverage means that a shock will result in relatively higher losses. This may cause the institutions in general to adjust their balance sheets, which e.g. may result in less lending to households and corporate customers, with potentially negative implications for the Danish economy.

The leverage of credit institutions, i.e. the institutions' assets relative to their capital, is used as an indicator of the strength of their balance sheets. Developments in the indicator should, however, be seen in the context of regulatory amendments having affected the scope for leveraging over time. Up to the most recent crisis, the leverage showed a slightly upward trend, cf. Chart 5.[10] Leverage declined, however, from the second half of 2005 until the beginning of 2007. The explanation is that high earnings during that period – and a major issuance of shares by a single group – strengthened the equity towards 2007. The subsequent leverage increase can be attributed to a substantial increase in assets without corresponding growth in the equity.

The key indicator of leverage is measured at group level. Leverage measured at bank and mortgage bank level, respectively, is also monitored, even though these are not included in the set of key indicators.[11] This is done to capture any rising leverage that is associated only with the banking or mortgage banking sector.

| Leverage of credit institutions |

Chart 5 |

|

|

Note: 4-quarter moving average. Leverage is measured at group level and defined as the sum of assets, guarantees and commitments divided by Tier 1 capital (including Additional Tier 1 capital).

Source: Danish Financial Supervisory Authority.

|

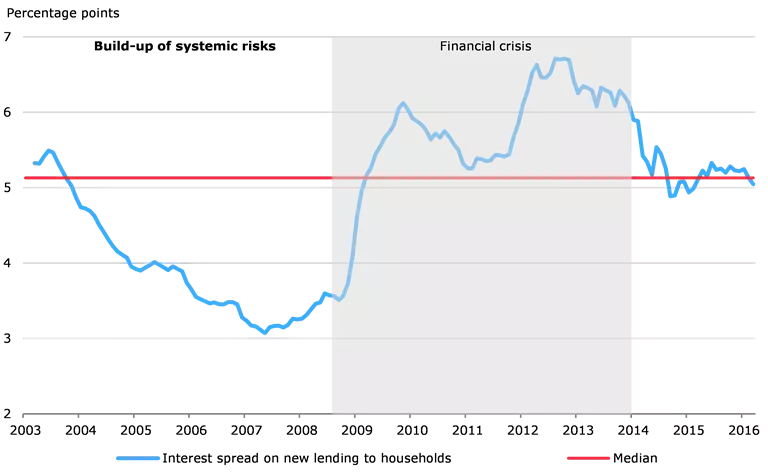

1.1.5 Key indicator 5: Banks' interest spread on new lending

Periods of overoptimism (risk illusion) in the economy may lead to excessive risk-taking among credit institutions and thereby build-up of systemic risks. This may be reflected in the institutions generally easing their credit standards more than warranted by the underlying economic development. This may make the institutions overall more vulnerable, although excessive increases in aggregate lending are not observed.

One indicator of credit standards is the banks' rate of interest on new lending to Danish households relative to a risk-free rate – here expressed as Danmarks Nationalbank's monetary policy rate. The banks' interest spread on new lending to Danish households fell in the period up to the most recent crisis, cf. Chart 6, indicating an easing of the credit terms.

| Interest spread on new lending to households |

Chart 6 |

|

|

Note: 3-month moving average. The interest spread is defined as the banks' lending rate on new lending, excluding overdrafts, relative to Danmarks Nationalbank's main monetary-policy interest rate (2003-2009: the lending rate, 2009-2016: the rate on certificates of deposit). Developments in the rate of interest on new lending reflect fluctuations in interest rate levels, but are also very much influenced by the distribution of new lending for the month, meaning that, viewed in isolation, a higher share of collateralised loans will reduce the total. The series has been adjusted for data breaks back in time.

Source: Danmarks Nationalbank.

|

1.2 Hovedindikatorer for frigivelse

Overall, it may be relevant to release the countercyclical capital buffer in three different situations: 1) If there is a decline in the identified risks that caused the buffer to be activated; 2) if there are indications that a systemic financial crisis is imminent; or 3) if a systemic crisis has set in.[12]

In cases where the identified risks slowly decline without a crisis having set in, this is expected to be reflected in the first five key indicators. In other cases the built-up systemic risks will materialise. This may result in stress in the financial markets, which may be a forewarning of a systemic financial crisis, e.g. because the market participants expect the credit institutions to suffer large losses. When the institutions suffer losses during a crisis, this will be reflected in indicators of the state of the sector, such as earnings. Situations 2) and 3) may thus be closely linked.

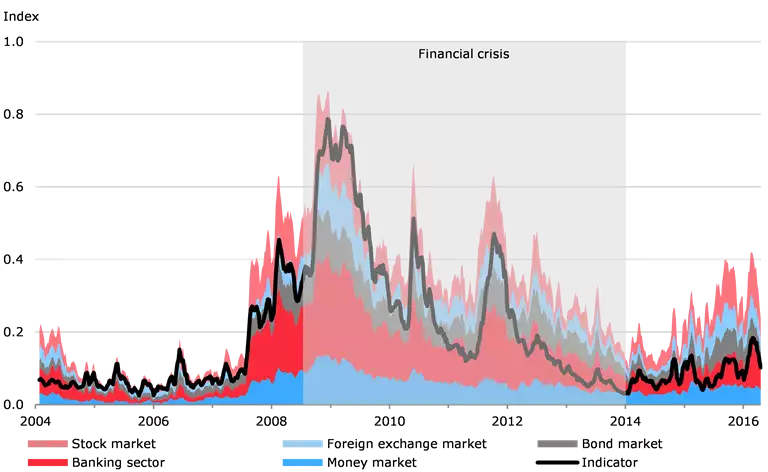

1.2.1 Key indicator 6: Financial stress indicator

High-frequency market indicators can be used to identify stress in the financial markets, since such indicators are quick to capture market reversals. If the financial stress level is high, this may indicate that a systemic financial crisis is imminent. However, the Council will bear in mind that short periods of market turmoil are not necessarily early indications of a financial crisis.

Financial stress may also in itself contribute to the onset of a systemic financial crisis. For example, the financial sector relies on financing in order to grant loans. Financing is in part provided by the capital markets. In periods of financial stress and distrust among market participants, access to those markets can be difficult. This may put pressure on the institutions to reduce their balance sheets and cause the institutions to tighten their credit standards and reduce the credit supply.

One indicator of general systemic stress is the financial stress indicator.[13] The indicator aggregates the levels of stress in five key submarkets and sectors of the Danish financial system: the money, bond, stock and foreign exchange markets and the banking sector. The stress indicator takes into account that simultaneous stress in several submarkets is a greater challenge to the financial system than periods of stress in individual submarkets.

The Danish stress indicator increased in the autumn of 2007, cf. Chart 7, when e.g. the unrest in the international money markets began. The systemic financial crisis is normally dated to the autumn of 2008, meaning that there was stress in the financial markets prior to the most recent crisis. The stress indicator gave an early indication that the buffer should be released, but looking forward, it may be used to compare the stress level at a particular time with the levels during previous crises, e.g. in the autumn of 2008.

| Financial stress indicator for Denmark |

Chart 7 |

|

|

Note: 4-week moving average. The value of the overall stress indicator is between 0 and 1. A value of 0 indicates very low volatility and high confidence in the financial system, while a value of 1 indicates that the five submarkets are all extremely dysfunctional and at the same time market participants are very nervous and risk averse.

Source: Bloomberg, Nordea Analytics and Danmarks Nationalbank.

|

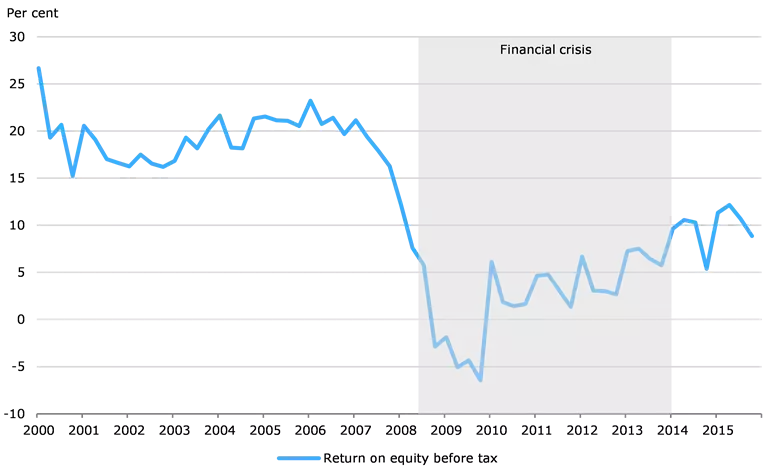

1.2.2 Key indicator 7: Credit institutions' aggregate earnings

Indicators of the state of the financial sector can be used to provide a picture of whether a crisis has set in with consequences for the institutions. In times of crisis, the institutions' loan impairment charges and losses will increase. The institutions recognise impairment charges on loans if there is objective evidence of impairment, while losses do not have to be reported until they are realised. Impairment charges as well as losses are reflected in the institutions' earnings. While earnings are high in good times, increased impairment charges and losses reduce earnings in times of crisis.

The return on equity is used as an indicator of the credit institutions’ aggregate earnings.[14] Earnings declined significantly from the end of 2007 to the end of 2008, cf. Chart 8, indicating that the systemic crisis which struck in the autumn of 2008 had begun to affect the institutions.

In situations of stress, in which release of the buffer is considered, earnings may also provide information about the need for releasing or continuing to maintain the buffer. If earnings in the sector are good, and there are no signs that the credit institutions will tighten their credit standards and reduce the credit supply to such an extent as to cause a credit crunch, this could call for postponing release of the buffer until the situation potentially deteriorates.

| Banks' return on equity |

Chart 8 |

|

|

Note: Quarterly data is annualised so as to be comparable with annual data. Weighted average.

Source: Danish Financial Supervisory Authority.

|

1.3 Other considerations

Step 2 involves other considerations aiming to add facets and insights to the picture emerging from step 1. This should ensure that the Council has the best basis for determining the level of the buffer rate in the last step. The various elements to be considered as a minimum are described below.

Other indicators

Developments in other indicators are used to put developments in the key indicators into perspective and to provide an overview of the overall risk outlook. With a view to the latter, the Council monitors a larger set of indicators that are discussed at each meeting of the Council.[15] The key indicators are put into perspective by considering related indicators. For example, as regards the credit-to-GDP gap, this would be done by decomposing the credit-to-GDP gap to examine whether developments are driven by credit or GDP. Moreover, the Council will conduct various robustness checks of the buffer guide, including calculations using different credit measures and trend calculations.

When the buffer is to be released, the Council will carefully consider the right time and whether the buffer is to be released at once or gradually. This would depend on the situation, cf. Appendix B.

State of the sector

Information about the state of the sector is used to provide a picture of the credit institutions' robustness. If there are indications of systemic risks building up, while the institutions have a low level of capitalisation, this calls for activating the buffer. In periods of crisis, information about impairment charges, dividend disbursements and excess capital adequacy would be taken into account when assessing whether institutions are under pressure. If the institutions are not under pressure, release of the buffer may be postponed until the situation potentially deteriorates. The state of the sector is assessed as part of the overall risk outlook every quarter.

Other policy measures

Other policy measures will also be taken into account when setting the buffer rate. The Council will assess whether measures other than the countercyclical capital buffer are better suited to addressing the risks identified. These may include both macroprudential and microprudential measures. Macroprudential measures aim to address systemic risks, i.e. risks where the entire system or large parts of the system are expected to be affected if risks materialise. Microprudential measures address risks of the individual institutions.

The Council will also take into account information about other measures that are being planned or already in use, including e.g. other macroprudential or microprudential requirements. They may also include future effects of fiscal or tax policies.

1.4 Advice

In step 3, the Council determines the level of the buffer rate based on an overall assessment of steps 1 and 2. If the credit-to-GDP gap exceeds its threshold of 2 percentage points as set out in international guidelines, the buffer guide is calculated, cf. Box 1. There will be no mechanical link between the buffer guide and the final advised buffer rate, as the Council assesses all key indicators and also considers other information (step 2).

2. Communication

The Council's advice on the buffer rate may be published after the Council's meetings. In the event of changes to the buffer rate, the Council will publish a recommendation addressed to the Minister for Business and Growth. Recommendations will be issued on a comply-or-explain basis. The Minister is responsible for determining the Danish buffer rate on a quarterly basis, cf. Appendix C. A recommendation from the Council will contain:

- The final buffer rate

- The buffer guide

- Justification for the recommendation on the final buffer rate based on the key indicators and other relevant information

- Appendix 1: Key indicators, including the buffer guide

- Appendix 2: Set of charts with other relevant indicators (see Appendix D)

If the buffer rate remains unchanged, including if it equals zero, the advice may be published in the usual press release, if relevant. The data underlying the indicators will be published every quarter on the Council's website.

3. Development of a decision model

Experience with use of the countercyclical capital buffer is scant and only few countries have activated the buffer at the beginning of 2016. Hence, methods and indicators for setting the countercyclical capital buffer continue to be under development.[16] In view of this, the Council's decision model will also be developed over time.

Literature

Abildgren (2007), "Financial liberalisation and credit dynamics in Denmark in the post-World War II period", Danmarks Nationalbank, Working Paper 47, October 2007.

Abildgren (2010), "Business cycles, monetary transmission and shocks to financial stability – empirical evidence from a new set of Danish quarterly national accounts 1948-2010", Danmarks Nationalbank, Working Paper 71, November 2010.

Bank of England (2014), "The Financial Policy Committee's powers to supplement capital requirements", A Policy Statement, January 2014.

BCBS (2010), "Guidance for national authorities operating the countercyclical capital buffer", Basel Committee on Banking Supervision, December 2010.

Behn, Detken, Peltonen, and Schudel (2013), "Setting countercyclical capital buffers based on early warning models: Would it work?", ECB Working Paper No. 1604.

Borio, (2012), "The financial cycle and macroeconomics: what have we learnt?", BIS Working Papers, No 395.

Cecchetti et al. (2011), "The real effects of debt", BIS Working Paper No. 352, September 2011.

Cecchetti and Kharroubi (2012), "Reassessing the impact of finance on growth", BIS Working Paper No. 381, July 2012.

Danmarks Nationalbank (2011), "Basel III and Danish mortgage banks", Financial stability, 2011.

Detken et al. (2014), "Operationalising the countercyclical capital buffer: indicator selection, threshold identification and calibration options", European Systemic Risk Board, Occasional Paper Series, No. 5/2014.

Drehmann (2013), "Total credit as an early warning indicator for systemic banking crises", BIS Quarterly Review June 2013.

Drehmann et al. (2010), "Countercyclical capital buffers: Exploring options", BIS Working Paper 317.

Drehmann et al. (2011), "Anchoring countercyclical capital buffers: the role of credit aggregates", BIS Working Paper No. 355.

Drehmann and Juselius (2012), "Do debt service costs affect macroeconomic and financial stability?", BIS Quarterly Review, September 2012.

Drehmann and Juselius (2013), "Evaluating early warning indicators of banking crises: Satisfying policy requirements", BIS Working Papers No. 421.

Drehmann and Tsatsaronis (2014), "The credit-to-GDP gap and countercyclical capital buffers: questions and answers", BIS Quarterly Review, March, pp. 55-71.

Edge and Meisenzahl (2011), "The unreliability of the credit-to-GDP ratio gaps in real-time: Implications for countercyclical capital buffers", Finance and economics discussion series, Federal Reserve Board 2011–37.

ESRB (2014), "Guidance on the setting of countercyclical capital buffer rates", European Systemic Risk Board, ESRB Recommendation, ESRB/2014/1.

Farrell (2013): "Countercyclical capital buffers and real-time credit-to-GDP gap estimates: a South African perspective", mimeo.

Knot (2014), "Governance of macroprudential policy", Banque de France, Financial Stability Review, No. 18, April 2014.

Gerdrup, Kvinlog and Schaanning (2013), "Key indicators for a countercyclical capital buffer in Norway – Trends and uncertainty", Staff memo no. 13, Financial Stability.

Act No. 268 of 25 March 2014 to amend the Danish Financial Business Act and various other acts.

Draft bill to amend the Danish Financial Business Act and various other acts, Bill No. L-133 2013-2014 introduced on 7 February 2014.

Van Norden, S. (2011), "Discussion of 'The unreliability of credit-to-GDP ratio gaps in real time: implications for countercyclical capital buffers'", International Journal of Central Banking 7 (4), pp. 299–303.

Appendix A: Definition of credit-to-GDP gap

The credit-to-GDP gap is defined as the deviations of the ratio of credit to GDP (credit-to-GDP ratio) from its long-term trend. BCBS (2010) sets out both credit definition and trend calculation guides, which are also included in the standard method in the ESRB's recommendation, ESRB (2014).[17] A broad definition of credit is used in both BCBS (2010) and the standard method in ESRB (2014). The broad definition for the Danish data is based on the quarterly financial accounts statistics and comprises loans to domestic households and non-financial corporations from both Denmark and abroad as well as securities issued (excluding equities). Using the broad definition reduces the probability of overlooking credit growth in other parts of the financial system, which is possible when using a narrower definition.

The challenge of the broad definition is that quarterly financial accounts are published a relatively long time after the end of a quarter. This means that the credit-to-GDP gap will be supplemented by another credit measure based on a narrower definition of credit under other indicators in step 2. The narrower definition is based on the balance sheet statistics for banks and mortgage banks (also called the MFI statistics[18]), which is published on a monthly basis, and includes lending to domestic households and non-financial corporations by banks and mortgage banks in Denmark.[19]

The trend used to calculate the credit-to-GDP gap is estimated by means of a recursive Hodrick-Prescott filter, HP filter, with a high smoothing parameter (λ=400,000).[20] This is in line with international guidelines, cf. ESRB (2014) and BCBS (2010). The first 20 quarters are applied to initialise the trend, which is then calculated recursively by adding one quarter at a time. This means that the trend is always estimated based on the information that is available at the time in question.

Ideally, the trend should reflect the underlying structural level, but as this cannot be observed directly, the level is estimated by a trend. The quality of the approximation is uncertain, however, so step 2 of the decision model contains various robustness checks of the buffer guide. Furthermore, the credit-to-GDP gap will also be supplemented with other credit development indicators, including annual lending growth. This is done to put the indicator into perspective without using the statistical trend.

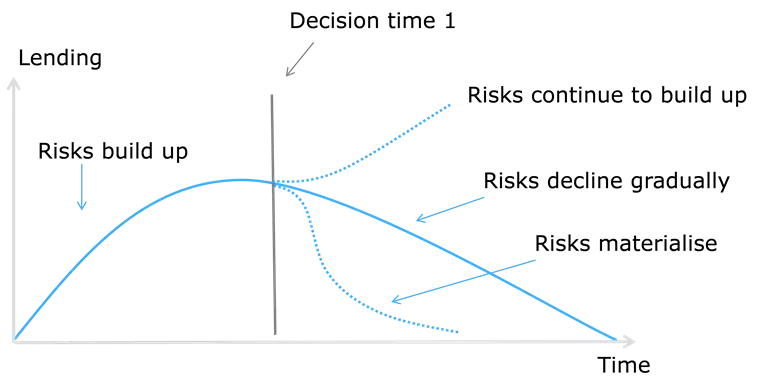

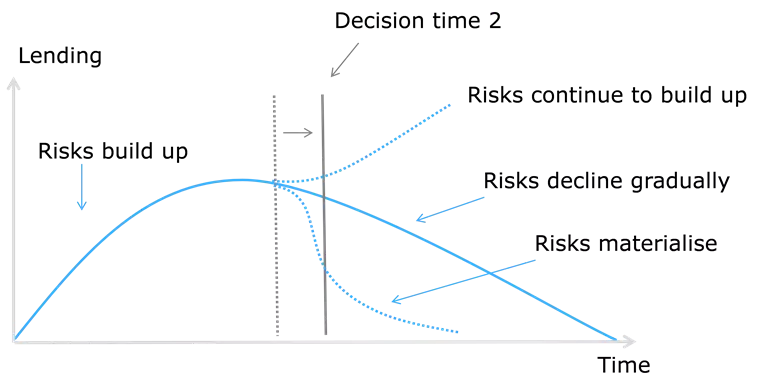

Appendix B: Considerations concerning release

In connection with the release of the countercyclical capital buffer, the Council will decide to what extent and when the buffer is to be released in view of the economic and financial situation. The buffer can be released either at once or gradually. This would depend on the situation. However, the current situation, particularly how conditions will develop in future, is rarely evident at a specific time, cf. Chart B.1. At decision time 1, risks may continue to build up, risks may gradually decline, or risks may materialise and cause a systemic crisis. It is thus a decision made under uncertainty. At each decision time, the Council faces the option of releasing the buffer or waiting until the next decision time, when new information will be available.

| Illustration of situations at the decision time for release |

Chart B.1 |

| Decision time 1 |

Decision time 2 |

|

|

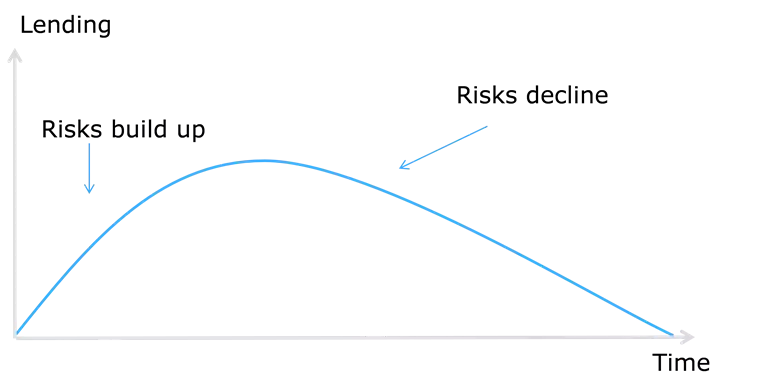

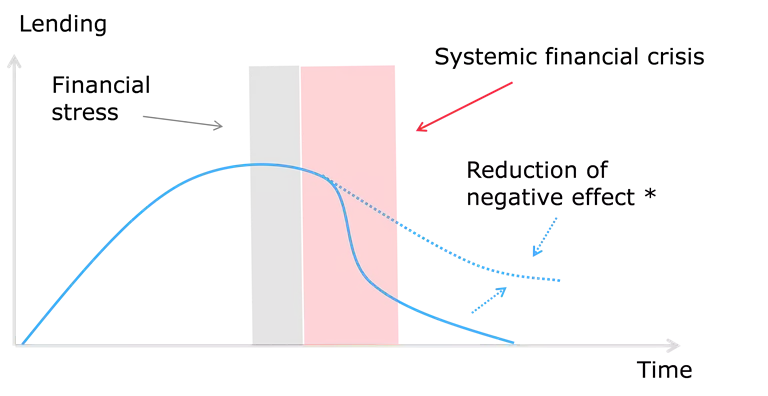

Overall, it may be relevant to release the buffer in three different situations:

- If the identified risks that caused the buffer to be activated decline

- If there are indications that a systemic financial crisis is imminent

- If a systemic financial crisis has set in

The three situations are illustrated in Chart B.2. In the situation where the identified risks slowly decline without a crisis having set in, the buffer can be released gradually. The buffer will probably be released at once in the two latter situations, which are closely linked. The reason is that periods of financial stress may precede systemic crises, as was the case with the most recent financial crisis.

| Illustration of situations when the buffer may be released |

Chart B.2 |

| No crisis |

Crisis |

|

|

| *Releasing the buffer may reduce the negative effect on lending. |

The purpose of releasing the buffer is to avoid a substantial reduction in lending, cf. the broken line in Chart B.2 (right). Whether the buffer should be released when a systemic financial crisis is imminent, or when it has already set in, depends on when releasing the buffer would best mitigate the negative effects on lending. The decision to release the buffer will to a large extent be based on an assessment. However, indicators can be used to support the decision. [21]

Appendix C: Background

The countercyclical capital buffer was introduced by the Basel Committee on Banking Supervision, BCBS, in December 2010 in connection with the Basel III rules.[22] The stricter Basel III requirements were implemented in EU legislation via the Capital Requirements Directive and the related Regulation (CRD IV/CRR). The countercyclical capital buffer is thus a macroprudential instrument in all EU member states. The Capital Requirements Directive was implemented in Danish law via a revision of the Financial Business Act implemented in March 2014.

The framework of the countercyclical capital buffer applying to credit exposures in Denmark will be phased in gradually over a number of years and can be set at up to 0.5 per cent of the total risk exposure amount in 2015, 1 per cent in 2016, 1.5 per cent in 2017, 2 per cent in 2018 and 2.5 per cent in 2019. After that time, the buffer rate can be set at a higher value if justified by the assessment basis. The buffer rate is measured in increments of 0.25 percentage point. Except in extraordinary circumstances, the applicable buffer rate will be announced at least 12 months before it will apply to the institutions.[23]

The requirement that the institutions must maintain a countercyclical capital buffer is a "soft" requirement. This means that the institutions will not lose their licenses if they do not meet the requirement, but they will be required to submit a capital conservation plan to the Danish FSA, and bonus and dividend payments will also be limited if they fail to comply with the total buffer requirement.[24]

In Denmark, the Minister for Business and Growth is the designated authority for the countercyclical buffer, i.e. the Minister decides whether the buffer is to be activated. This means that the Minister is responsible for setting the buffer rate for domestic credit exposures and for evaluating the level of the buffer rate every quarter. According to the explanatory notes to the Danish Financial Business Act, the Minister should take the following into account when setting the buffer rate:

- The buffer guide

- The ESRB's recommendation on setting a countercyclical buffer rate, cf. below

- Other variables deemed relevant in order to address cyclical systemic risks.

In connection with the quarterly setting of the buffer rate, the Minister for Business and Growth must publish an announcement on the website of the Ministry of Business and Growth, cf. the Danish Financial Business Act. This also applies when the buffer rate is unchanged from the previous quarter. As a minimum, the announcement must provide information about:

- The current buffer rate, including justification thereof

- A measure of the credit-to-GDP ratio and the credit-to-GDP gap

- The buffer guide

- The date when the institutions must fulfil the buffer when the buffer rate is raised.

- When the buffer rate is reduced, a recommended period during which the buffer rate is not expected to rise. The buffer rate can be fully or gradually reduced, depending on the circumstances.

In June 2014, the ESRB published a recommendation, ESRB (2014), on guidance for setting countercyclical capital buffer rates. The ESRB recommends, inter alia, that, in addition to the credit-to-GDP gap, the designated authorities should monitor a set of alternative variables that also indicate the build-up of cyclical systemic risks. Such variables include:

- Measures of potential overvaluation of property prices

- Measures of credit developments

- Measures of external imbalances

- Measures of the strength of bank balance sheets

- Measures of private sector debt burden

- Measures of potential mispricing of risk

- Measures derived from models that combine the credit-to-GDP gap and a selection of the above measures (multivariate models)

The ESRB recommends that the designated authorities should publish at least one variable from each measure, except the latter, to accompany the quarterly announcement of the countercyclical buffer rate. It is assumed that the data are available and that the variables are deemed to be relevant.

In addition, the ESRB recommends that the designated authorities should monitor a set of alternative variables providing information about whether the buffer should be maintained, reduced or released completely. Such variables include:

- Measures of stress in the bank funding markets, e.g. the spread between money market interest rates or bank CDS premia.

- Measures that indicate general systemic stress, e.g. a composite indicator such as the ECB's Composite Indicator of Systemic Stress, CISS)

If such variables are available and relevant in the countries concerned, the ESRB recommends that at least one variable from each measure should be published to accompany the quarterly announcement of the countercyclical buffer rate. In order to be able to decide whether the buffer should be maintained, reduced or released completely, the ESRB recommends that the designated authorities should exercise greater judgement when monitoring the variables.Andre landes buffersatser

Buffer rates in other countries

Other countries' buffer rates have influence on Danish institutions with international exposures. In Denmark, banks, mortgage banks and the so-called investment firms I (hereinafter referred to as the institutions) will be required to maintain a countercyclical capital buffer. The institution-specific countercyclical capital buffer rate will be calculated as the weighted average of the countercyclical buffer rates applying to the countries in which the institution has exposures. For example, if an institution has 90 per cent of its risk exposure in country A, which has set a buffer rate of 1 per cent, and 10 per cent of its risk exposure in country B, where the buffer rate is 2.0 per cent, the institution will be required to maintain an institution-specific countercyclical capital buffer of (0.9*1+0.1*2) per cent. = 1.1 per cent of its total risk exposure amount.

In Denmark, the Minister for Business and Growth is responsible for assessing and recognising buffer rates in other countries. There is mandatory reciprocity of buffer rates for credit exposures up to 2.5 per cent. The Minister for Business and Growth may decide to use other countries' buffer rates of more than 2.5 per cent. The Danish Financial Supervisory Authority is responsible for supervising whether the individual institutions meet the institution-specific requirements.

Appendix D: Other relevant indicators

In addition to the key indicators and the buffer guide, the Council will publish other indicators on its website, cf. the section on communication in the main text.

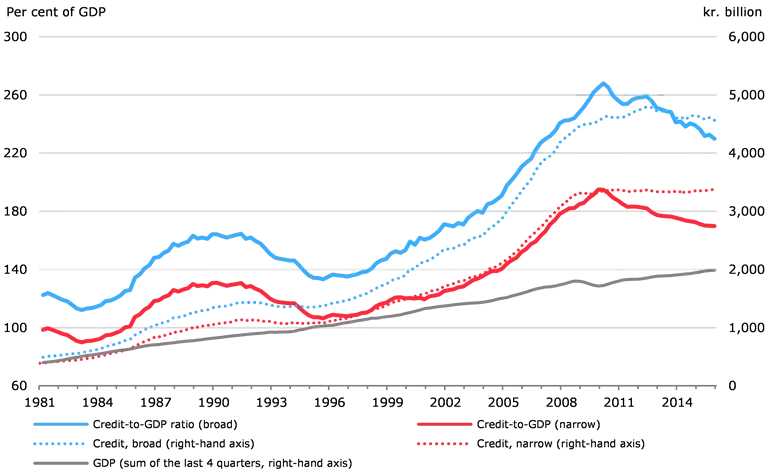

The Council's five key indicators represent five of the categories in the ESRB's recommendation, cf. above. The ESRB recommends the publishing of a further indicator of credit developments. Hence, the Council will supplement the credit-to-GDP gap with data on the broad credit measure as well as a narrower credit measure, cf. Chart D.1. The credit-to-GDP gap can be decomposed by publishing the GDP series at the same time. Moreover, data for the narrow definition are published on a monthly basis 19 banking days after the end of the month, while data for the broad measure are published on a quarterly basis 90 days after the end of the quarter.

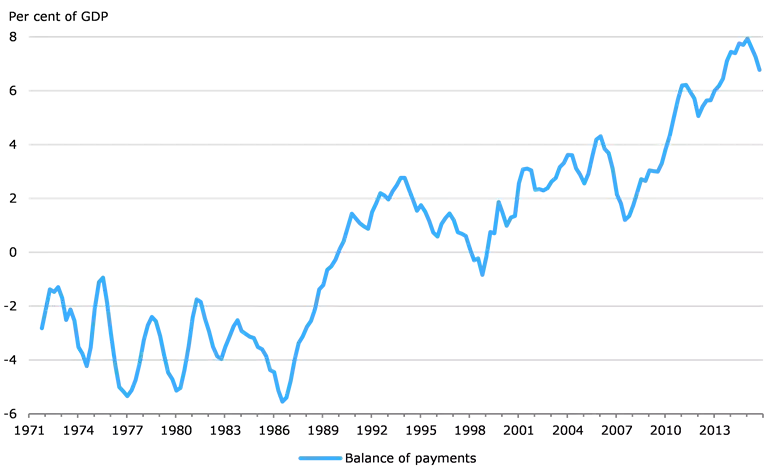

An indicator of the category "measures of external imbalances" is not included as one of the Council's key indicators, as it is not deemed relevant as a basis for the activation of the buffer. However, external imbalances will be aggravating circumstances, and hence the category is monitored as part of the general monitoring of risk in step 2 of the decision model. In order to accommodate the ESRB's recommendation, the Council will publish the balance of payments in per cent of GDP, cf. Chart D.2, as an indicator of this category.[25]

As a starting point, Charts D.1 and D.2 (with related data) will be published every quarter. In addition, the Council may select and publish other relevant indicators that may vary from time to time and which are included in the justification for the selected buffer rate.

| Broad and narrow definition of credit and GDP |

Chart D.1 |

|

|

Note: For the broad and narrow definitions, see Appendix A. The series have been adjusted for data breaks back in time.

Source: Abildgren (2010), Statistics Denmark, the MONA data bank, Danmarks Nationalbank.

|

| Balance of payments-to-GDP ratio |

Chart D.2 |

|

|

Note: The balance of payments-to-GDP is shown as a 4-quarter moving average.

Source: Statistics Denmark.

|

[1] For the majority of the key indicators, the period under review comprises two systemic crises in Denmark. The first crisis struck in the 1st quarter of 1987, while the second crisis began in the 3rd quarter of 2008.

[2] Credit comprises loans to the domestic private non-financial sector from Denmark and abroad as well as corporate bonds issued. See Appendix A for more details.

[3] The trend is estimated on historical data, see Appendix A for more details.

[4] See e.g. Drehmann et al. (2010) and Detken et al. (2014).

[5] Both directly and via real economic effects, see e.g. Cecchetti et al. (2011) and Cecchetti and Kharroubi (2012).

[6] Detken et al. (2014) find that this indicator is the best house price indicator in a study across EU member states.

[7] Bank of England (2014) and Detken et al. (2014) also show that house prices in several countries have increased in periods leading up to bank crises and fallen one or two years ahead of a crisis.

[8] The fall in the house price-to-income gap is attributable to stagnation in the house price-to-income ratio, while the trend continued to rise as a result of increases in the house price-to-income ratio in the preceding period.

[9] At the international level, Drehmann and Juselius (2013) find that the debt service ratio, in addition to the credit-to-GDP gap, is a good indicator to predict financial crises. The results found by Detken et al. (2014) across the EU member states are not as good.

[10] Several countries' banking crises were linked to high and increasing leverage. This is the case of the most recent financial crisis and the Nordic banking crisis in the early 1990s, cf. e.g. Bank of England (2014). However, Detken et al. (2014) do not find that leverage is a good indicator to predict crises across EU member states. This should presumably be viewed in the light of regulatory amendments in several member states. Behn et al. (2013) find that leverage contributes to predicting crises in models using several explanatory variables across countries.

[11] The leverage of banks and mortgage banks is included in the overall monitoring by the Council. Data for the leverage of banks is found for a longer period than for leverage at group level. In the run-up to the crisis in the late 1980s, the leverage of banks showed a slightly upward trend.

[12] See also Appendix B.

[13] In terms of methodology, the Danish stress indicator is identical to that of the ECB, only deviating where special Danish circumstances require this. For example, the Danish stress indicator includes the mortgage credit market rather than the market for corporate bonds. For more details, see Danmarks Nationalbank, Financial stability, 2nd Half 2014.

[14] Aggregate earnings are mentioned as a possible indicator of the release phase in e.g. Drehmann et al. (2010). International studies find mixed signals for indicators of conditions in the financial sector, see e.g. BCBS (2010) and Drehmann et al. (2011).

[15] See the memo "Monitoring of systemic risks" on the Council's website..

[16] In June 2014, the ESRB published guidance for setting the countercyclical capital buffer in the form of a recommendation, cf. Appendix B.

[17] In ESRB (2014), it is possible to measure and calculate the credit-to-GDP gap using an alternative method if this reflects national conditions better than the standard method. However, the alternative credit-to-GDP gap must be calculated and published in addition to the standardised credit-to-GDP gap.

[18] MFI: Monetary Financial Institutions.

[19] Also includes lending to residents by the Danish institutions' foreign units.

[20] The trend in the credit-to-GDP gap is estimated for the period from 1st quarter 1970 to 4th quarter 2015 in this memo.

[21] International empirical studies find that signals from indicators related to the release phase are typically less robust than those related to the build-up of the countercyclical capital buffer. The reason is that the indicators are often more noisy. This may result in many false signals that a crisis has set in or is imminent. Furthermore, the time series for the high-frequency indicators are often relatively short. See e.g. Drehmann et al. (2011) and Detken et al. (2014).

[22] Read more about Basel III in e.g. Danmarks Nationalbank (2011).

[23] The institutions must meet the countercyclical capital buffer requirement with Common Equity Tier 1 capital.

[24] In addition to the countercyclical capital buffer, the total buffer requirement consists of the capital conservation buffer and the systemic risk buffer.

[25] Ultimately, the Minister for Business and Growth as the designated authority is responsible for complying with the recommendation.