The Government is required, within three months, to either comply with the recommendation or explain why the recommendation has not been complied with. If the Council considers that the actions taken do not sufficiently follow the Council's recommendation, the Council must publish its evaluation of the consequences for systemic risks.

Evaluation of the Government's response to the Council's recommendation[1]

The Government has chosen not to follow the Council's recommendation to restrict access to interest only mortgage loans in Denmark for now. Against this background, the Council assesses that vulnerabilities in the housing market continue to be a source of systemic risks to both the economy and the financial system.

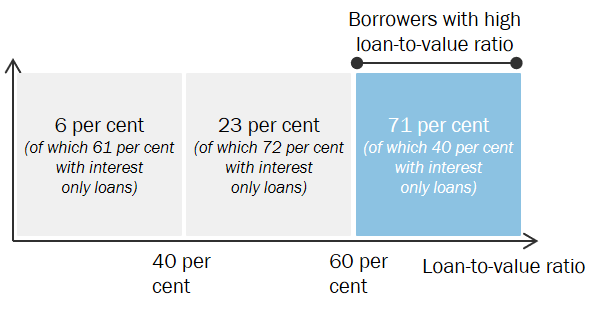

Interest only loans are widely prevalent in Denmark, also among highly indebted homeowners, see Graph 1. Easy access to interest only loans encourages homeowners to incur disproportionately heavy debt burdens. Combined with the low level of interest rates, interest only loans make it possible to obtain large debts for a very low monthly instalment. A high level of heavily indebted homeowners increases the risk of coinciding losses following negative shocks to the Danish economy. The widespread use of interest only loans creates negative externalities at the macro level and thus contributes to the build-up of systemic risks.

In its response to the Council, the Government points out, that financial stability and households’ resilience is currently not at risk. This assessment is based on the slow-down of house price growth over the last few months. The Government highlights that the household debt-to-GDP ratio is considerably below the level prior to the financial crisis. At the same time, the Government points to a number of financial regulation initiatives regarding mortgage lending implemented since the financial crisis.

The Council does not consider that a slow-down of house price growth will in itself reduce the build-up of systemic risks related to the widespread use of interest only loans among highly indebted households. A slow-down in price growth does not eliminate the inexpedient incentive to incur high debt inherent to interest only loans, especially with the current very low interest rate level. It should also be considered, that the Council's recommendation was primarily aimed at increasing the resilience of Danish homeowners and the financial system, which is not sufficiently addressed by current regulatory initiatives. The purpose of the recommendation has not been to regulate house price developments.

The Council will continue to monitor developments in the housing market as well as developments in household debt and the use of interest only mortgage loans.

| Distribution of new interest only loans by loan-to-value ratio, 1st and 2nd quarters 2021 |

Chart 1 |

|

Note: The chart is based on a weighted average of the mortgage credit institutions' gross new lending for the 1st and 2nd quarters of 2021.

Source: Own calculations based on the credit registry. |

[1] The representatives from the economic ministries and the Danish Financial Supervisory Authority have no voting rights regarding recommendations addressed to the government, and are therefore not part of the evaluation of recommendations addressed to the government.