Build-up of systemic financial risks in Denmark

Activity in the Danish economy is now back at the same level as prior to the pandemic. Further increases in activity are expected over the autumn after the last restrictions have been removed. At the same time, there are signs of bottlenecks in both the labour market and in supply chains.

Financial conditions are very loose, and many asset prices have surged. Interest rates are low, and market participants expect interest rates to remain low over the coming years. Low yields on safe assets have boosted interest in risky investments, and investor compensation requirements for assuming credit, liquidity and interest rate risk have been further reduced. The current outlook of very loose financial conditions, increasing asset prices and prospects of a strong rise in economic activity provides ground for risk build-up. Experience from earlier economic cycles shows, that an economic upswing can quickly shift to a downturn. It is therefore crucial that risks are managed closely during the upswing.

Although overall credit development is moderate, credit growth is high in areas with sharp house price increases around the largest cities. At the same time, there are signs of increasing lending to non-financial corporations where credit demand has been subdued for a while, especially amongst lock-down affected industries as a result of government relief packages and loan schemes.

Credit institution earnings increased in the 2nd quarter of 2021. In addition, credit institutions raised their return on equity expectations for 2021 to pre-pandemic levels. The increase in earnings is primarily due to limited amount of losses related to covid-19. At the same time, core earnings have not significantly improved. The low interest rates, in combination with a continued cyclical upswing, high asset prices and intensified competition for customers may provide an incentive for credit institutions to increase their risk-taking.

Follow-up on recommendation on the housing market

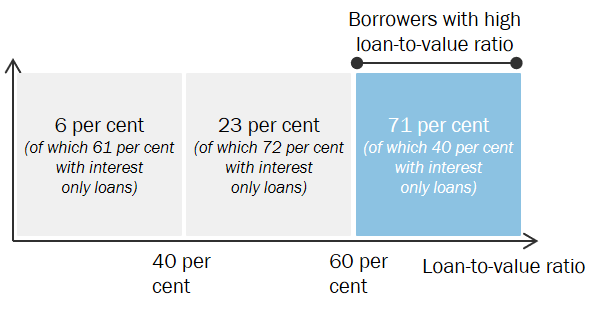

At its previous meeting, the Council issued a recommendation to the Government to tighten Danish homeowners' access to interest only mortgage loans if the loan-to-value ratio exceeds 60 per cent. Interest only loans are quite wide spread in Denmark, also among highly indebted homeowners. The share of new interest only mortgage loans has increased to 53 per cent of total new lending in the 2nd quarter.

The Government has decided not to follow the Council's recommendation for now, but will increase monitoring of the residential real estate market, including use of interest only loans. (Link, only in Danish) In its response to the Council, the Government points to the slow down in price growth over the past few months. Furthermore, the Government does not find the current level of credit growth alarming. The Council finds, that the Government’s decision implies that systemic risks related to interest only loans among highly indebted households remain unaddressed, see also Appendix 1. Danish homeowners will continue to have access to interest only mortgage loans up to the maximum loan-to-value threshold. In combination with the very low interest rates, interest only loans encourage homeowners to incur disproportionately heavy debt burdens.

Countercyclical capital buffer

The Council recommends that the countercyclical capital buffer is kept unchanged at present. Each quarter, the Council assesses the appropriate level of the buffer rate in light of the developments in risk build-up in the financial system.

At its meeting in December 2021, the Council expects to recommend an increase of the buffer rate of 1.0 percentage point to 2.0 per cent. This would allow the higher buffer rate of 2,0 per cent to apply as of the end of 2022. Step-wise increases of the buffer rate are in line with the Council's strategy of gradually increasing the buffer rate to a level of 2.5 per cent.

Systemic risk buffer

With the implementation of the Capital Requirements Directive, CRD V, in Denmark, it has become possible to set a systemic risk buffer in addition to the other capital buffer requirements. The systemic risk buffer can be used if there are general systemic risks that are not addressed by other macroprudential instruments. The current implementation implies that the Minister must assess the need to activate the systemic risk buffer by the end of 2021.

A number of indicators point to general systemic risks in Denmark. Risks are primarily related to Denmark being a small open economy vulnerable to shocks from abroad, the high debt levels among households and corporates, and credit institutions' exposures to the real estate market.

The Council is in the process of assessing the need to activate the systemic risk buffer. The Council expects to complete its assessment as to whether the buffer should be activated, and if so, at what level during 2022. Therefore, the Council recommends to the Minister for Industry, Business and Financial Affairs not to activate the systemic risk buffer at present. From 2022 onwards, the Minister for Industry, Business and Financial Affairs is expected to have to assess the systemic risk buffer at least every two years.

Other issues

The Council was briefed by the Danish Financial Supervisory Authority on IT risks in the financial sector and on the measures initiated by the Authority to reduce risks.

The Council was also briefed on international experience with various solutions for recovering a bank's services following a major IT breakdown. The work with data protection and recovery will continue under the auspices of i.a. the Financial Sector Forum for Operational Resilience, FSOR.

For further information, please contact mail@risikoraad.dk or Teis Hald Jensen, Communications and Press Officer, on tel. +45 3363 6066.

Appendix 1. Follow-up on recommendation from the Systemic Risk Council[1]

In June 2021, the Systemic Risk Council, the Council, issued a recommendation to the Danish Government to restrict Danish homeowners' access to interest only mortgage loans. The Council recommended that interest only mortgage loans are only granted to borrowers with a loan-to-value ratio below 60 per cent of the value of the home.

The Government is required, within three months, to either comply with the recommendation or explain why the recommendation has not been complied with. If the Council considers that the actions taken do not sufficiently follow the Council's recommendation, the Council must publish its evaluation of the consequences for systemic risks.

Evaluation of the Government's response to the Council's recommendation

The Government has chosen not to follow the Council's recommendation to restrict access to interest only mortgage loans in Denmark for now. Against this background, the Council assesses that vulnerabilities in the housing market continue to be a source of systemic risks to both the economy and the financial system.

Interest only loans are widely prevalent in Denmark, also among highly indebted homeowners, see Graph 1. Easy access to interest only loans encourages homeowners to incur disproportionately heavy debt burdens. Combined with the low level of interest rates, interest only loans make it possible to obtain large debts for a very low monthly instalment. A high level of heavily indebted homeowners increases the risk of coinciding losses following negative shocks to the Danish economy. The widespread use of interest only loans creates negative externalities at the macro level and thus contributes to the build-up of systemic risks.

In its response to the Council, the Government points out, that financial stability and households’ resilience is currently not at risk. This assessment is based on the slow-down of house price growth over the last few months. The Government highlights that the household debt-to-GDP ratio is considerably below the level prior to the financial crisis. At the same time, the Government points to a number of financial regulation initiatives regarding mortgage lending implemented since the financial crisis.

The Council does not consider that a slow-down of house price growth will in itself reduce the build-up of systemic risks related to the widespread use of interest only loans among highly indebted households. A slow-down in price growth does not eliminate the inexpedient incentive to incur high debt inherent to interest only loans, especially with the current very low interest rate level. It should also be considered, that the Council's recommendation was primarily aimed at increasing the resilience of Danish homeowners and the financial system, which is not sufficiently addressed by current regulatory initiatives. The purpose of the recommendation has not been to regulate house price developments.

The Council will continue to monitor developments in the housing market as well as developments in household debt and the use of interest only mortgage loans.

| Distribution of new interest only loans by loan-to-value ratio, 1st and 2nd quarters 2021 |

Chart 1 |

|

Note: The chart is based on a weighted average of the mortgage credit institutions' gross new lending for the 1st and 2nd quarters of 2021.

Source: Own calculations based on the credit registry. |

[1] The representatives from the economic ministries and the Danish Financial Supervisory Authority have no voting rights regarding recommendations addressed to the government, and are therefore not part of the evaluation of recommendations addressed to the government.